Updated December 17, 2024

What’s in your travel wallet is as much about what you take with you on your trip as what you leave at home. It’s also the result of figuring out what should go in your wallet, and what needs to be carried elsewhere. Consider these 15 tips to protect money and valuables such as documents and related travel essentials while traveling.

Table of Contents

- Tips to protect money and valuables

- 1. List your travel essentials

- 2. Identify what’s needed to securely stow your essentials

- 3. Use digital aids for purchases and tracking

- 3. Become familiar with currency conversion rates and tools

- 4. Choose ATMs carefully

- 5. Consider a prepaid card for ATM use

- 6. Consider a travel account with a limited balance

- 7. Favour using credit cards over debit or cash

- 8. Pack debit and credit card backups

- 9. Save leftover cash from previous travels

- 10. Carry just enough cash for the day

- 11. Consider carrying business cards

- 12. Find a convenient place for a transit card

- 13. Carry identification

- 14. Create a traveller’s emergency contact card

- 15. Practise cyber security

- Conclusion

Tips to protect money and valuables

1. List your travel essentials

A list can help you identify what purses, security pouches, or other travel organizers might best suit your travel style.

Here are a couple of suggestions.

- Go through your ‘at-home’ wallet and cull what won’t be needed on your trip. Leave the personal cheques, and most loyalty and membership cards at home. The same applies to unnecessary identity documents such as a birth certificate or social insurance card.

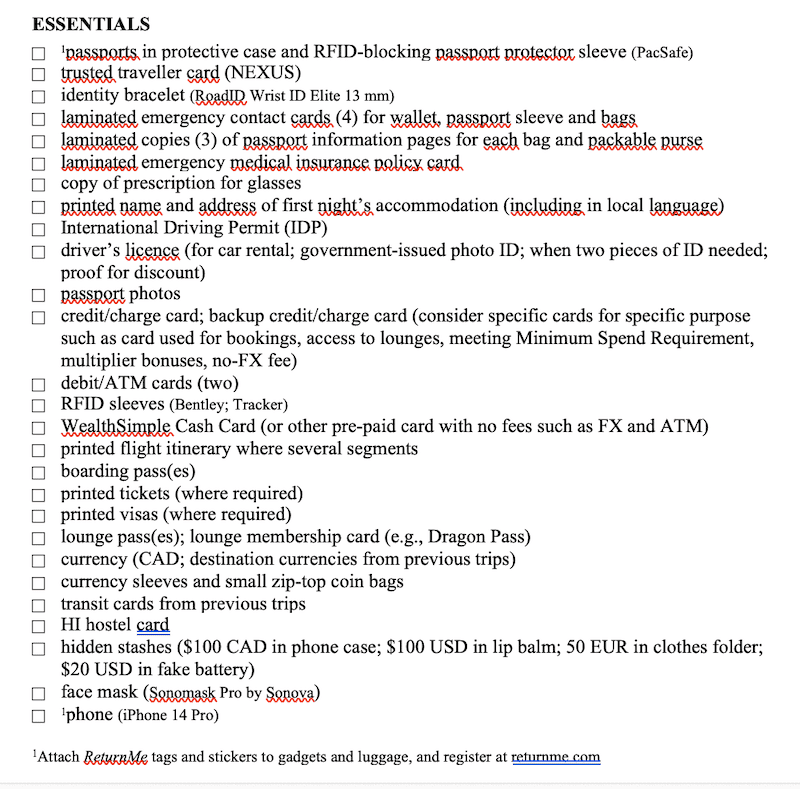

- ‘Essentials’ could be one of the categories on your packing list. Add anything associated with finances and identity. Make a note of what documentation will be required to leave and return to your home country, and enter and leave other countries on your itinerary. Think about how you’ll access and manage finances while on the move. It could also include information for responding to emergency situations. Here’s an example:

2. Identify what’s needed to securely stow your essentials

Some travellers use a travel document organizer for their passport, itinerary, boarding passes, trusted traveller card, tickets, bookings, and any other documentation needed while in transit. They’re usually zippered, and come with a removable wrist strap.

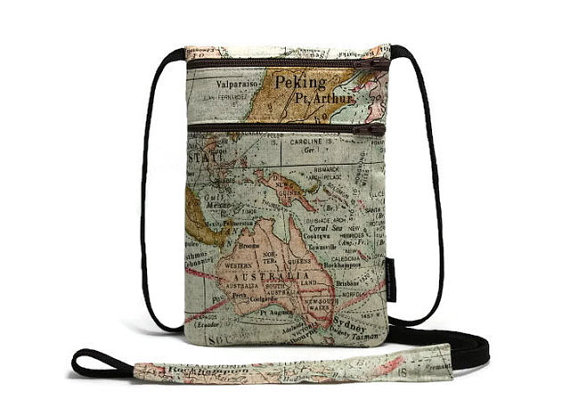

How about a wearable travel organizer? It’s secure and convenient as while in transit, there’s never a need to remove it, except at a screening checkpoint when it can be stuffed into the bag used as a personal item.

When juggling a jacket, bag, boarding pass, and photo ID or passport at the boarding gate, a hands-free organizer is easier to manage. I have a handmade one from Etsy seller, KapomCrafts. One of the advantages of shopping at Etsy is that you’ll be able to find a seller who’ll make one according to your specifications. What about a packable travel purse? Mine is small enough to be worn during the entire flight or bus ride, so there’s little danger of pilfering while I’m sleeping or away from my seat. Internal compartments housing my passport, travel wallet, currency, iPhone, and iPad mini require the opening of two zippers to access the contents.

What about a packable travel purse? Mine is small enough to be worn during the entire flight or bus ride, so there’s little danger of pilfering while I’m sleeping or away from my seat. Internal compartments housing my passport, travel wallet, currency, iPhone, and iPad mini require the opening of two zippers to access the contents.

This makes it more difficult for pickpockets. And, unlike commercial travel organizers, it doubles as an evening purse, and a backup day bag. For more information, see Designing the perfect travel purse.

Under-clothing security pouches worn around the waist, neck, or leg hide valuables from sight. Some are hidden from view after being attached to a belt, belt loop, or bra. It’s virtually impossible for a thief to access a security pouch unless it’s taken by force. They can be useful for day-to-day use, or during transit without screening checkpoints.

I like one that rests in the small of my back under a waistband such as the PacSafe RFID Safe 100. It’s so comfortable I forget I’m wearing it. If you’re considering one, get it in black. The grey develops a soiled look after several years of use. To expand your options, check out waist belts and armbands designed for runners.

Clothing with hidden, internal, or engineered pockets is another favourite.

For commercially produced options, SCOTTeVEST and Clothing Arts are companies that pride themselves on their pickpocket-proof travel clothing. I particularly like SCOTTeVEST’s travel vest, and Clothing Art’s Cubed Travel Jacket. It’s surprising how much stuff can be packed in either one of these garments, and they’re easily removed at screening checkpoints. This is particularly useful when travelling on airlines with a one-bag carry-on allowance.

For handmade options, check out Etsy or look for resources within in your community. For ideas, see Stop pickpockets with an assortment of anti-pickpocket gear.

A cross-body bag can be very useful as a travel organizer and day bag. PacSafe and Travelon are brands that are popular for loading their bags with a host of security features. My Travelon Anti-Theft Active Tour Bag works well as a personal item and as a day bag at my destination.

Travelon Anti-Theft Active Tour Bag

Travelon Anti-Theft Active Tour Bag

A slim minimalist wallet should be small enough to fit in a front pocket, inside pocket of a jacket or vest, or a zippered internal compartment of a purse. RFID (Radio-frequency identification) protection provides additional security. My favourite is the FurtArt Slim Minimalist Wallet with a built-in D-ring to tether to hardware within a pocket or purse.

Consider complementing your travel wallet with a phone case with a slot or hidden pocket. This is handy for items such as a credit card, hotel or hostel card key, address of your accommodation, or an emergency contact card. My favourite is the Smartish Wallet Slayer case with a secure pocket. Place a tether tab inside the case for attaching a lanyard or leash. For ideas, see 12 Must-have features of a phone wallet case for travel.

3. Use digital aids for purchases and tracking

Debit, credit, and prepaid cards can be added to a digital wallet (i.e., Apple Wallet, Google Wallet, or Samsung Wallet) on a phone or watch to be used at the point of purchase.

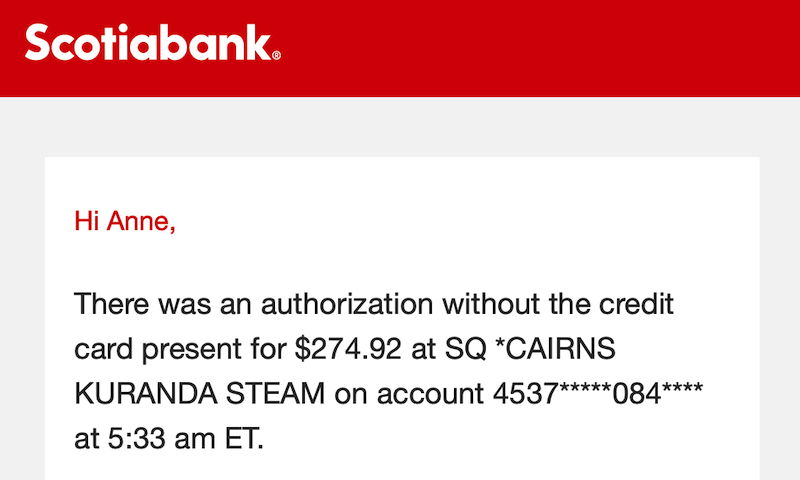

To make it easier to check and verify transactions, sign up for online and mobile banking for each account and financial card. Better still, set up a system of alerts on each transaction. With Scotiabank, for example, the alert via text and email is instantaneous, displaying the conversion of the transaction to my home currency.

3. Become familiar with currency conversion rates and tools

Some people create a currency conversion cheat sheet, but this information can be easily accessed via an app such as XE currency.

Or use an online Currency Converter Calculator (e.g., used by MasterCard or Visa) to convert from the transaction currency to your card’s currency. If your card issuer charges a foreign transaction fee (typically, in Canada it’s 2.5%), insert the fee and the date of the transaction to obtain the converted amount that should appear as a charge on your account.

If a merchant or ATM offers Dynamic Currency Conversion (DCC), you’ll likely be offered the choice to pay in the local currency or your home currency. Always choose the local currency which results in the card processor (e.g., Visa or MasterCard) choosing the conversion rate. Leaving it to the merchant’s bank to choose invariably results in a higher-than-market currency conversion rate and fees, anywhere from 6% to 10%.

4. Choose ATMs carefully

Before visiting an ATM, familiarize yourself with current currency conversion rates.

Don’t use ATMs in airports, hotels, stores, or tourist areas. Chances are ATMs located inside banks are safer and less likely to have been objects of tampering. Use a bank ATM during banking hours, preferably when accompanied by another person who stands guard. Before approaching a machine, spend time observing others, looking for people who seem to be loitering. Thieves often work in pairs around ATMs so if other people are nearby, wait for them to complete their business and leave. Concentrate on what you’re doing and ignore any movement designed to distract you.

Always shield the keypad when entering a PIN and if the machine swallows your card, you’ll be able to report it immediately. As you’re waiting for the transaction to be processed, place one hand over the slot where your card will be returned and the other by the cash-dispenser tray. A slight distraction can easily result in a thief making off with your card or cash.

Skip the Euronet ATMs with their ATM fees and unfavourable currency conversion rates to the detriment of the traveller. Besides, only tourists use them and thieves know this.

5. Consider a prepaid card for ATM use

Consider using a prepaid card such as Wise, EQ, or Wealthsimple. Look for one with no monthly fees, no minimum deposit, no loading, inactive, foreign transaction, and ATM fees. (However, you may be charged an ATM fee by the ATM provider.) In addition to these features, my Wealthsimple Cash account earns 2.75% interest.

Another advantage of my Wealthsimple prepaid MasterCard account is that with no minimum deposit or balance, I control how little or how much of a balance to carry, which is safer in case of unauthorized transactions. Increasing the funds in my account is instantaneous via the Wealthsimple app.

6. Consider a travel account with a limited balance

Several years ago, I set up a travel account at a financial institution that’s separate from the financial institution housing my other accounts and investments. The travel account has no monthly fee and the account balance is limited. It is linked to my Wealthsimple prepaid MasterCard account for easy and instantaneous transfer of funds.

Another layer of protection is that the travel account has a low daily withdrawal limit. With instantaneous alerts, I receive immediate notification if my account has been compromised.

7. Favour using credit cards over debit or cash

Choosing to use credit cards over debit or cash has several advantages. They leave a trail of recorded purchases and avoid per-transaction ATM fees. If a credit card is lost, stolen, or compromised resulting in fraudulent charges, the cardholder is rarely liable for them. Used strategically, credit cards earn valuable travel points by unlocking sign-up bonuses and points multipliers on category spending.

It also means not having to carry substantial amounts of cash.

You may be advised by your card issuer to not use tap for the first couple of in-person credit card purchases. Instead, insert the actual card and enter the PIN. This alerts the credit card fraud detection algorithms that the card is physically travelling and has been verified by the cardholder. After a couple of chip-and-pin transactions, use the tap functionality.

8. Pack debit and credit card backups

It takes a little planning, but separate your cards. If you’ll be stopping by an ATM, carry your debit card in your wallet and your credit cards elsewhere. Pack a backup credit card, preferably from a different issuer (e.g., Visa, MasterCard, American Express). Always keep the backups separated from your main cards. Some people travel with a second debit card or prepaid cash card in case several ATMs don’t recognize their main card.

Information associated with those cards should be stowed elsewhere. Carry PIN numbers in your head, and all other details in a password-protected digital password wallet such as 1Password or DataVault. Don’t make a copy of your cards, unless they’re digital versions in a password-protected file. A physical copy is just one more thing to keep secure.

9. Save leftover cash from previous travels

Leftover cash from a previous trip incurs fees when converting to your home currency. Consider saving it for a future trip. Or you may know someone who has recently returned and might appreciate selling you the cash at the current conversion rate (without the fees).

Even in countries that have moved to a cashless economy, there may be occasions when cash is required. On a recent trip to Norway, I took two free (tip-based) walking tours. One guide carried a mobile machine to accept credit card payments and the other didn’t (but accepted other currencies besides Norwegian kroner).

10. Carry just enough cash for the day

Set up a travel account with a financial institution where ATM fees are waived or refunded. You’ll be less likely to make fewer withdrawals of larger amounts. Even if you mostly use credit cards, it’s always wise to carry some cash for unexpected, miscellaneous expenses. Not all places accept credit cards, and some merchants offer a better price for cash or add a credit card surcharge.

Put what you’ll need for the day’s expenses in your wallet, and carry a few coins and small bills in a pocket (or outer pocket of a purse) for convenience. This makes it easier to support the work of street performers, or to pick up a snack from a street vendor without having to reach for your wallet.

Leave the majority of your cash in a safe, money belt, or under-clothing security pouch. If you need to access your money belt or security pouch, don’t forget to plan ahead so you can do so in private.

In addition, carry emergency cash in various places. Ensure each banknote is undamaged, in a currency and denomination that can be easily changed, and is protected from the elements. Locations might include a shoe, empty container (e.g., lip balm or travel-sized deodorant), or taped to a packing cube or inside of luggage. See Stop pickpockets with an assortment of anti-pickpocket gear for ideas.

11. Consider carrying business cards

A business card is a wonderful timesaver when sharing contact information with others while travelling. Carry a few in your day bag and put one in your wallet. If your wallet is lost and falls into the hands of a Good Samaritan, it can help identify you, and how you can be contacted. Put one in a pocket of outerwear for the same reason. Depending on how much information it contains, it can also double as a luggage tag.

It’s surprisingly easy to design your own cards at sites such as Moo and Vistaprint. Moo’s Printfinity technology allows you to put different images on each card. You can even order cards (Moo’s Business Cards +) with embedded Near Field Communication (NFC) chips.

Also, carry the business card of your hotel. It’s easy to get lost in a foreign city, especially when you’re jet lagged, and the street signs are in another language. If you carry the business card of your hotel with you, it can be shown to a taxi driver or helpful local who can help get you back to your accommodation.

12. Find a convenient place for a transit card

Transit cards offer convenience and savings. In fact, in cashless transit systems, they’re a requirement. Some passes provide unlimited travel, while others permit you to top up with prepaid amounts and ride for a discount. Many electronic ticket readers allow you to leave your card in a pocket or purse, and simply wave it close to the machine. This is handy in areas where pickpocketing is common. Reaching for your wallet for your transit card or to pay cash for a fare gives the heads-up on the location of your wallet, and clues on how easy or difficult it might be to steal. Find a convenient place for a transit card, preferably, not in your wallet.

13. Carry identification

A driver’s licence can be useful, even if you don’t plan on renting or otherwise driving a vehicle. When asked to present some form of photo identification or government-issued ID, it’s usually more convenient to reach for a driver’s licence than to dig out a passport. In fact, if you lose your passport, a driver’s licence can be used to confirm your identity when applying for an emergency replacement. For younger travellers, it can verify proof of age if you’re carded. For senior travellers, use it as proof of eligibility for the senior’s discount.

If you belong to a group or industry that typically receives discounts or benefits when travelling, carry the respective card with you. Many museums and attractions offer discounts. Reduced rates and other benefits are available for accommodation and transportation. If you plan on staying in HI Hostels, you may receive a reduced rate with a Hostelling International membership (that can also be used to obtain backpackers’ discounts elsewhere). If you’re a teacher or student, consider applying for an internationally recognized card.

Also, carry a laminated copy of the information page of your passport. Except when crossing a border, there have been countless occasions when my laminated copy has been acceptable and convenient. See 9 Tested reasons to carry laminated copies of your passport for details.

14. Create a traveller’s emergency contact card

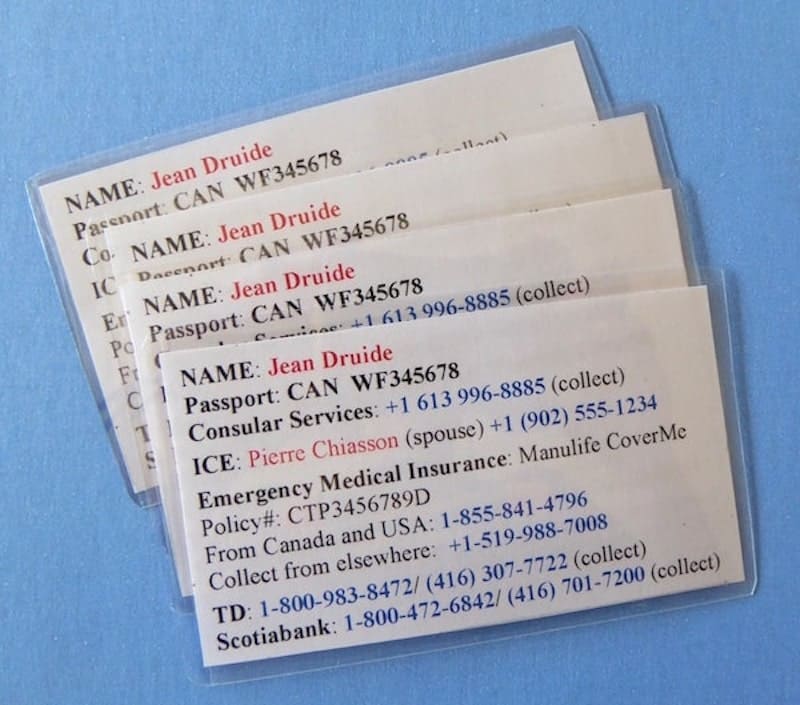

Create your own credit-card-sized collection of emergency contact numbers. Include your ICE (In Case of Emergency) contact person(s), financial institutions, consular services, and emergency medical insurance administrator. Make several copies and get them laminated. Carry one copy in your wallet, another in your phone case, and spread the others throughout your belongings. Leave one behind with a stay-at-home family member. See How to make a traveller’s emergency contact card in 5 easy steps for more information.

Also, carry emergency medical insurance information. If your insurance company issues you a client card, carry it in your wallet. If there’s a downloadable version, insert your name, policy number, and toll-free number and have it laminated. Most insurance providers require contact before seeking treatment. If adversity strikes, you’ll be able to fulfil your policy obligations. Or, someone else will be able to call on your behalf.

15. Practise cyber security

Before logging in to any account from public Wi-Fi, connect your VPN (Virtual Private Network). A VPN encrypts your data and masks your IP address, hiding your browsing activity, identity, and location. For more information, see 5 Critical reasons why you need a VPN when you travel.

In addition, pack a data blocker and use it when using public charging stations to charge your devices. A data blocker prevents malware from entering a device through the USB port by disabling the pins used for data transfer. For more information, see Do you need a USB data blocker when you travel?

Conclusion

Protecting money and valuables involves being intentional about what’s in your travel wallet. Here are some suggestions:

- one financial card

- driver’s licence

- business card

- emergency medical insurance card

- traveller’s emergency contact card

- cash for that day’s expenses

What’s in your travel wallet?

If you found this post helpful, please share it by selecting one or more social media buttons. What additional suggestions do you have for carrying essential travel documents? Please add your thoughts in the comments. Thank you.

If you found this useful, the following related posts contain additional information:

- Stop pickpockets with an assortment of anti-pickpocket gear

- Designing the perfect travel purse

- Shop Etsy travel products: 11 useful examples

- How to make a traveller’s emergency contact card in 5 easy steps

Pin it for later?

Some of the links on this page are affiliate links. If you use them to buy something, you don’t pay more, but Packing Light Travel earns a small commission which helps pay the costs of maintaining the site. Thank you for your support.

Great post! I don’t have a special case for it but I like to stick a business card and some emergency cash in my phone case too. I just slip it behind the phone.

Great suggestion, Krista. Thank you for dropping by, and sharing your ideas.

Anne Betts recently posted…Cambodia’s Ta Prohm: Angkor’s jewel

helpful information. Thanks for sharing. I remember those things while travelling

Hello @Anne,

This is so helpful information you have shared with us. I loved to read this informative article. Everything has represented in a pretty good way. Thanks for explaining such a helpful ideas and i defenitely follow this to safely carry my money, documents, and some related travel essentials. Keep sharing. Good wishes for your upcoming articles.