Updated February 25, 2025

Is the TD Rewards program worth it? How does the program work? What are the various ways to use TD Rewards points to reduce travel costs? What qualifies as a travel cost?

After several years of earning and redeeming TD Rewards points for travel, I’ve found the program to be beneficial. Here is my review.

Table of Contents

- What are TD Rewards Points?

- How to earn TD Rewards

- TD First Class Travel Visa Infinite Card

- What are TD Rewards worth?

- How to use TD Rewards points to reduce travel costs

- What qualifies as Book Any Way travel?

- How to redeem TD Rewards for travel

- Is the TD First Class Travel Visa Infinite worth it?

- Is the TD Rewards program worth it?

- Conclusion

What are TD Rewards Points?

TD refers to the Toronto-Dominion Bank. TD’s propriety loyalty program is called TD Rewards. The rewards currency is TD Rewards Points. To improve readability, I’ll refer to the points as ‘TD Rewards.’

TD Rewards can’t be converted to any other loyalty currency, or transferred to another loyalty program. It used to be possible to convert TD Rewards to Aeroplan on a product switch to a TD Aeroplan-branded card at a rate of 4:1. However, since April 2019, this is no longer the case.

Points don’t expire as long as your TD Rewards-earning credit card account is in good standing. If you close your credit card account (and don’t have another TD Rewards-earning credit card), you’ll have 90 days to redeem any points left in the account. But, if you lose access to Expedia For TD, they’ll be redeemable at the lower ‘book any way’ value.

As a general rule, points in any in-house program should be redeemed or transferred to another credit card earning the same rewards currency before cancelling or product switching a card.

How to earn TD Rewards

TD Rewards can be earned from a credit card sign-up bonus, through everyday spend on the credit card, and the occasional promotion.

TD Rewards credit cards

TD offers four credit cards earning TD Rewards:

- TD First Class Travel Visa Infinite Card

- TD Platinum Travel Visa Card

- TD Rewards Visa Card

- TD Business Travel Visa Card

Promotions

TD offers very few points-earning promotions.

The best way to stay abreast of these opportunities is via promotional emails from TD.

TD First Class Travel Visa Infinite Card

For travellers, the best of the three personal credit cards is the First Class Travel Visa Infinite, last overhauled on October 30, 2022. And effective April 30, 2025, several improvements will be available for new and existing cardholders.

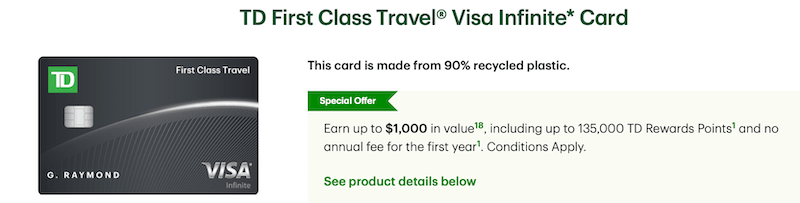

TD offers promotions on the TD First Class Travel Visa Infinite with elevated sign-up bonuses of up to 135,000 points and an annual fee waiver ($139) in the first year )latest offer effective January 7, 2025.

According to the terms and conditions, the offers aren’t available to customers who have activated and/or closed a TD First Class Travel Visa Infinite Account in the last 12 months. However, this may or may not be enforced. Also, a product switch from a lower-tier card may (or may not) be eligible for the full promotional benefits.

The TD First Class Travel Visa Infinite also includes:

- a birthday bonus of 10% of the points earned in the 12 months preceding the primary cardholder’s birthday (up to a maximum of 10,000 points)

- an annual TD Travel Credit of $100 each calendar year on certain bookings (hotel, motel, lodging, vacation rental, or vacation package) of $500 or more at Expedia for TD in cash, points, or a combination of points and cash.

- a free Uber One membership for 12 months

Effective April 30, 2025, the following features will be added with no additional cost or devaluations of benefits or redemptions:

- complimentary membership to Visa Airport Companion (operated by Dragon Pass) with four complimentary lounge visits per year

- elevated earning rates on public transit (6 points per dollar), streaming, digital gaming and media (4 points per dollar), and drinking establishments such as bars, cocktail lounges, and nightclubs (6 points per dollar).

The current earning rates on the TD First Class Travel Visa Infinite are:

- 8 points per dollar for travel booked online or by phone at Expedia for TD

- 6 points per dollar spent on groceries and at restaurants

- 4 points per dollar on regular recurring payments

- 2 points per dollar on all other purchases

There’s a $25,000 cap on spending at the accelerated rates. After that threshold is reached, the earning rate decreases to the base rate of 2 points per dollar.

What are TD Rewards worth?

At first glance, the earning rate on the TD First Class Visa Infinite looks very attractive. That’s because most fixed-point reward programs can be redeemed at one cent per point (e.g., 10,000 points = $100). With TD Rewards, the best possible redemption rate is 0.5 cents per point (e.g., 10,000 points = $50).

How to use TD Rewards points to reduce travel costs

TD’s travel portal is Expedia For TD, operated by Expedia.

There are two ways to redeem TD Rewards for travel purchases:

- Expedia for TD

- ‘Book Any Way’

Each has a different redemption value.

(i) Expedia for TD

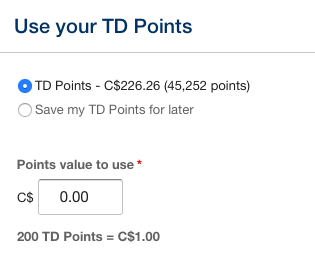

For travel booked through Expedia For TD, points are valued at $0.05 (200 points = $1).

For the most part, Expedia for TD mirrors what’s available on Expedia. However, there are gaps in the inventory. Also, some folks have reported higher prices on Expedia for TD, compared to what’s posted on Expedia.

For what it’s worth, that hasn’t been my experience. For example, a search for a specific hotel in Halifax revealed the best price at Expedia when compared with other booking sites.

The (almost) same price for the same property appeared at Expedia for TD.

(ii) Book Any Way

‘Book Any Way’ covers travel purchased from travel providers other than Expedia For TD. This allows you to book and redeem points for travel products that don’t appear on Expedia. This includes the option to book last-minute deals or discounted travel at prices that are cheaper than what’s listed at Expedia.

However, TD Rewards are valued at $0.04 (250 = $1) on the first $1,200 of a Book Any Way travel purchase. The value increases to $0.05 (200 = $1) for any amount that is over $1,200 on the same purchase. This is useful for ‘big-ticket’ bookings such as vacation packages or apartment rentals.

Keep in mind that when purchasing from a provider other than Expedia For TD:

- you’re earning x2 TD Rewards Points (instead of x8 at Expedia for TD); and

- you’re redeeming at a lower value of $0.04 (instead of $0.05).

What qualifies as Book Any Way travel?

The program has a broad view of what qualifies as travel. Flights, accommodation, cruises, vacation packages (usual stuff) are eligible. Expenses such as theatre tickets, golf fees, resort excursions, restaurant bills, gasoline, taxi fares, and parking may qualify if they’re incurred while travelling.

How to redeem TD Rewards for travel

(i) Expedia For TD

The most convenient way is to book online by signing in to TD Rewards, and entering the Expedia For TD portal to shop for travel.

When you’re ready to make a decision, one click takes you to your chosen travel product.

Another click takes you to the payment page with helpful pre-populated fields showing the name of the cardholder, credit card, TD Rewards account balance, and its monetary value.

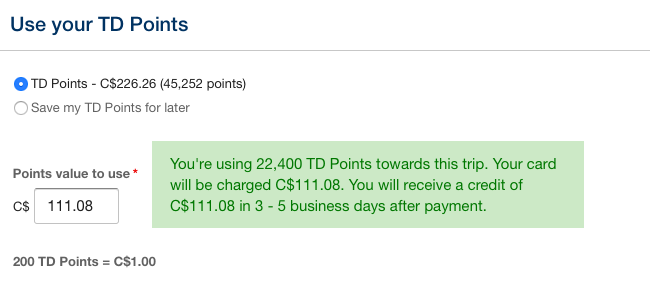

You can choose to charge the entire amount to your credit card by choosing the “Save my TD points for later” option. Or, choose “Points value to use,” insert the amount and an information box will appear with explanatory notes on the points (and their monetary value) that will be applied.

You can choose to charge the entire amount to your credit card by choosing the “Save my TD points for later” option. Or, choose “Points value to use,” insert the amount and an information box will appear with explanatory notes on the points (and their monetary value) that will be applied.

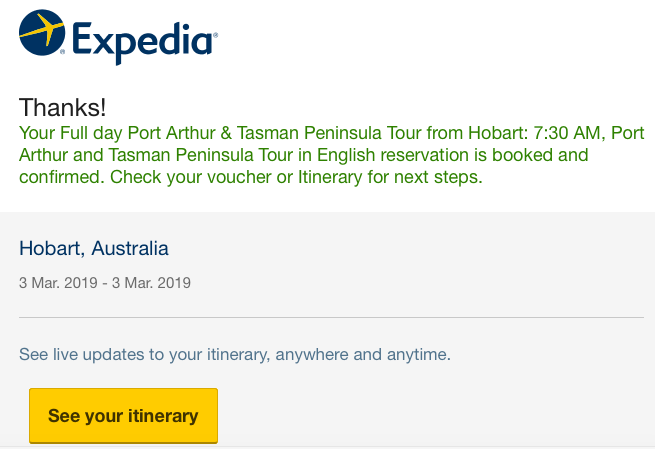

Within moments, an email arrives from Expedia for TD with the booking confirmation and details.

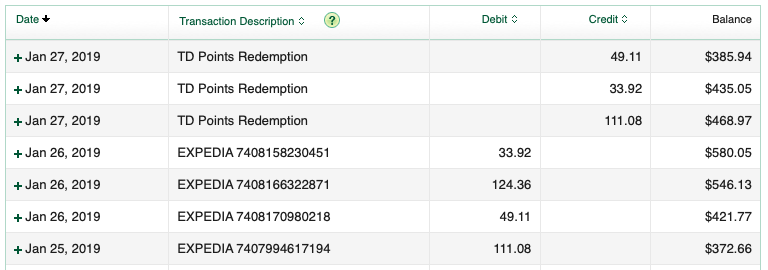

With the “use points” option, the entire travel purchase, including taxes and fees, will be charged to your credit card. But, because you used TD Rewards Points, you’ll receive a credit on your credit card statement within 5 days after the charge, equal to the number of points used.

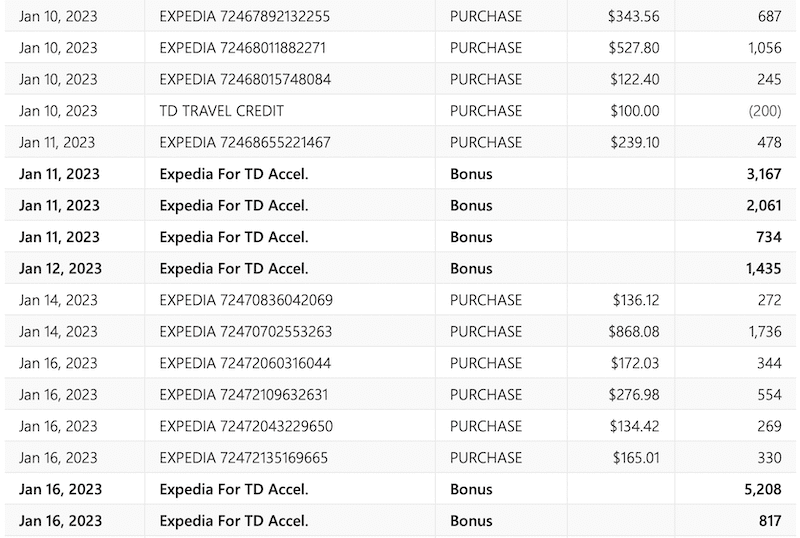

For the best return, anything appearing at Expedia should be booked online through Expedia For TD and redeemed in this way. Another option is to book by telephone (at Expedia for TD). The points multiplier of x8 for using Expedia For TD will be earned on each booking. Travel purchases and their respective statement credits will appear as separate line items.

(ii) Book Any Way

- Make a travel-related purchase using the credit card earning TD Rewards.

- Wait until the charge posts to your credit card account.

- Call TD Rewards within 90 days of the transaction date of the purchase, and ask to have points applied.

- The points will be deducted from your points balance available at the time the points are redeemed, not the transaction date of the purchase.

- The amount credited towards the purchase will be equal to the value of the points redeemed. If there are insufficient points available to cover the entire amount, the remaining cost will be posted on the account for payment.

Both redemption routes (Expedia For TD and Book Any Way) allow payment in any combination of points and cash.

Note: Travel usually delivers the best rate of return. However, TD Rewards can be redeemed for merchandise (at an average of 0.23 cents per point), gift cards (0.25), tuition, or paying down a student loan debt (0.4), or as a credit against your credit card account (0.25). These redemption values are shared with thanks to Credit Card Genius for their research and analysis.

Is the TD First Class Travel Visa Infinite worth it?

To keep a First Class Travel Visa Infinite permanently in your wallet, I say YES if the following applies to you:

- You purchase a considerable amount of travel through Expedia (for TD).

- You’re likely to make a single purchase of $500 or more (on specified types of accommodation) at Expedia for TD to earn the annual travel credit of $100.

- You like the idea of offsetting a variety of travel costs with various rewards programs.

- You’re not loyal to any particular hotel brand and you use a variety of accommodation that’s bookable through Expedia (for TD).

- You’re able to tap into a fee waiver and a decent sign-up bonus.

- You have a TD All-Inclusive Banking Package. This requires a minimum daily balance of $5,000 in your account. It entitles you to a $29.95 monthly fee rebate ($22.45 for seniors aged 60 or older). It includes an annual fee rebate of your choice of one of five select TD credit cards. The TD First Class Travel Visa Infinite is one of the cards. The rebate covers the fees for the primary cardholder and one supplementary cardholder.

- You can make use of the travel insurance benefits.

NO, if:

- You use Expedia sparingly. You don’t use it enough to justify paying the annual fee of $139 (beginning in the second year under a first-year-free promotion).

- Most of your flights are award bookings using frequent flyer miles or points. When you do purchase a revenue ticket, you book flights directly with an airline because of better service in the event of booking irregularities, flight cancellations, and overbooked flights.

- You’re a member of one or more hotel loyalty programs. You book directly with the respective program to earn loyalty points, status credits, and other benefits.

- The other credit cards in your wallet have superior earning power on everyday-spend categories such as groceries, gas, transit, and dining, and/or earn flexible points that are convertible to other reward programs offering better redemption values.

Is the TD Rewards program worth it?

Yes, when used in conjunction with other reward programs, the TD Rewards program can be very helpful in reducing miscellaneous travel costs. For access to flights in premium cabins, luxury accommodation, or aspirational travel experiences, there are other, more valuable programs.

For a personal credit card, I believe the best of the bunch is the TD First Class Travel Visa Infinite Card. What are the benefits and shortcomings of the TD Rewards program and the TD First Class Travel Visa Infinite Card?

Advantages

- When used exclusively for travel bookings at Expedia for TD, the TD First Class Travel Visa Infinite Card offers an appealing return of 4%. Otherwise, a mixture of earn rates puts the return somewhere between 1% and 4%.

- For the most part, Expedia has a solid reputation. The company carries some weight in the travel world and could be a useful ally if things don’t go as planned with a small, independent tour operator. However, I’d never use Expedia for expensive long-haul flights. Overbooked flights, delays, cancellations, and other disruptions can put passengers in a zone where neither the airline nor the OTA (Online Travel Agency) will provide assistance.

- I like Expedia For TD’s large inventory of accommodation options, including hostels and apartments, at a variety of price points. I’ve also been impressed by the attractiveness of refundable bookings. For example, the same property at Booking dot com might be refundable up to a month out, whereas at Expedia, it might be refundable up until the day before arrival. This limits reliance on trip cancellation insurance.

- TD’s recent overhaul of the TD First Class Travel Visa Infinite that included a $100 annual travel credit is a welcome benefit. It requires a purchase of $500 or more at Expedia for TD once in a calendar year (that is relatively easy to accomplish when booking accommodation). Triggering the credit requires no intervention on a cardholder’s part as an email and secure message from TD arrives within 48 hours. This effectively reduces the annual fee of $139 to $39, a compelling reason to keep the card.

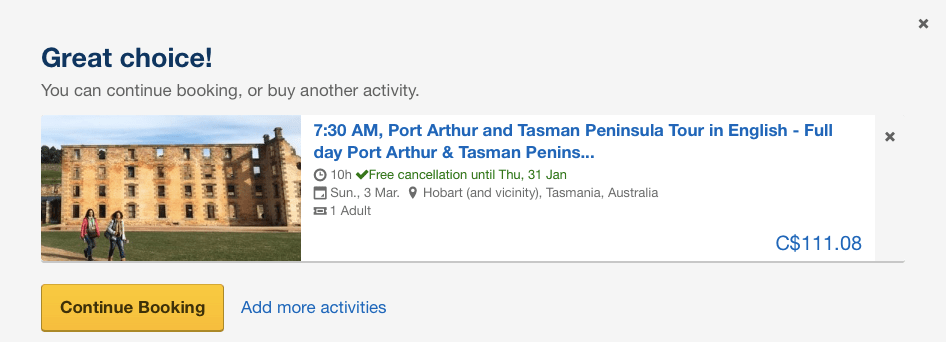

- There’s also the option to book tours and experiences. Other propriety programs (e.g., AMEX Travel) don’t offer a similar range and variety of travel products.

- I love the online system for booking travel at Expedia For TD, and redeeming points against the purchase. It involves inserting a minimal amount of information, and a few clicks to complete the process. Within seconds, the booking confirmation arrives by email.

- Anything appearing at Expedia for TD is bookable online from anywhere in the world. Expedia For TD’s online booking process is convenient, user-friendly, and efficient.

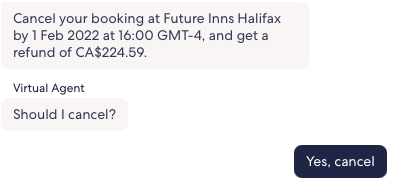

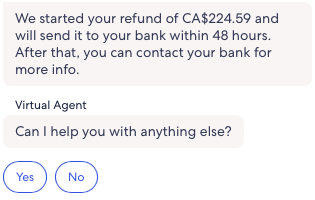

- The same applies to the online process for changing a reservation or using Expedia for TD’s Virtual Assistant to cancel refundable bookings. Sign in, select the booking, hit the cancel button, and receive notification that the refund will be sent within 48 hours.

- The range of travel expenses redeemable as Book any Way travel is impressive.

- With the accelerated earn rate of 6 points per dollar resulting in a 3% return on groceries and dining, I’ve appreciated having the TD First Class Travel Visa Infinite Card in my wallet at restaurants that don’t accept American Express (such as Cobalt and Scotiabank Gold cards that both earn x5 points on dining).

- TD has a no-fee credit card (TD Rewards Visa Card) that earns TD Rewards. This presents an option to product switch from the TD First Class Travel Visa Infinite (or any other credit card earning TD Rewards) to protect your points and keep a TD Rewards account active.

- TD has a generous approach to product switches that encourage clients to try different credit card products. Some switches provide access to full promotional benefits. In addition, there are cases where clients have been able to hold more than one TD First Travel Visa Infinite Card at the same time.

- For credit card cancellations and product switches, TD offers prorated refunds of annual fees.

- TD’s system generates the $100 travel credit within a couple of days, and cardholders don’t need to wait until the statement date to see points awarded on sign-up bonuses and bookings.

- The TD All-Inclusive Banking Package presents an option to obtain an annual fee rebate.

- TD’s EasyWeb account management system is efficient and user friendly. After product switching or applying for a new TD credit card, I’ve had the card, with the credit card number, appear in my account within a few hours. On a product switch, the ‘switched-from’ card can be used almost immediately to earn points in the ‘switched-to’ card’s rewards program. This is handy to start working on the new card’s Minimum Spend Requirement without having to wait for the new card to arrive by mail.

- There will be others who don’t agree but in my opinion, of the ‘big five,’ TD has the best customer service. For the most part, I’ve found Customer Service Representatives to be helpful, patient, and well informed. Those I’ve dealt with have been more than willing to follow up on requests, listen to, and consider, my interpretation of terms and conditions when it differs from theirs, and seek information from advisors and supervisors.

Shortcomings

- To extract maximum value on travel purchases and redemptions, customers need to use Expedia For TD. When purchasing travel from other providers (at an earn rate of 2 points per dollar), and redeeming points using ‘Book any Way’ at the lower redemption value, each point is valued at only 0.8 cents (or 0.8% return).

- At the present time, the program doesn’t have a flight rewards chart where it could be possible, as with other reward programs, for members to extract greater value when redeeming points for flights. For example, the CIBC Rewards (Aventura) Flight Reward Chart offers the potential of a 2.2% return.

-

-

- For more information on the CIBC Rewards program, see How to use CIBC Aventura points to reduce travel costs

-

- Expedia for TD’s Virtual Assistant works well on uncomplicated bookings such as obtaining a refund before the fully refundable date. However, in the case of complications, the Virtual Assistant is hopeless. For example, in Warsaw, the guide on a scooter tour was a no-show on the day of the tour (so it was past the refundable period) and trying to get the Virtual Assistant to retrieve the booking was impossible, despite inserting my answers to each question asked.

- As a rewards currency, TD Rewards has limited value. It’s not convertible to any other program, and it has a fixed maximum value of $0.05 per point.

- While obtaining a fee rebate on an all-inclusive banking account is an attractive proposition, doing so on a TD Aeroplan-branded credit card might make more sense for Aeroplan account holders. Aeroplan is capable of delivering much greater value than TD’s fixed-value system.

- Setting up preauthorized payments from a bank account other than TD requires a visit to a branch. In my case, that means a return trip of 110 kilometres. For credit cards from other financial institutions, setting up preauthorized payments can usually be accomplished via online banking or a mobile app.

- I’m not fond of having two-tiered redemption values for travel purchases. Other proprietary programs such as Aventura and Scene+ make no distinction between travel booked through the program’s travel portal, and that from another provider. Redemption values are the same.

-

-

- For more information on the Scene+ program, see How to use Scene+ points to reduce travel costs

-

- If a customer has two credit cards earning TD Rewards, it’s possible to merge the points into one account but it must be done by an agent (by phone or the ‘live chat’ feature accessed through online banking). But disappointingly, fewer than 10,000 TD Rewards cannot be moved from one account to the other.

- While the recent (October 2022) and future (April 2025) enhancements are welcome, the TD First Class Travel Visa Infinite Card doesn’t stand out among its competitors. It’s competing with travel credit cards that offer companion/buddy passes, NEXUS fee rebates, free checked baggage, concierge services, and no FX (foreign exchange) fees. However, as mentioned earlier, the annual $100 travel credit helps fill a much-needed gap in its attractiveness as a travel credit card.

- The insurance benefits are on par with other premium credit cards. Personally, I’ll never use them. For emergency medical insurance, an annual multi-trip plan from an insurer of my choice is a better fit for my age and travel style. The trip cancellation/interruption doesn’t apply because a covered trip is one where “the full cost has been charged to Your Account and/or using Your TD Points.” Like many other travellers, my trips are funded from a variety of sources using a mixture of reward points and cash.

- It’s both a blessing and a curse but I’ve been surprised by the types of charges flagged by TD’s fraud detection system. This results in a rejection of the charge and a freezing of my credit card until it’s sorted.

Conclusion

The fact that TD has hitched its rewards wagon to Expedia makes it an interesting proposition. I’m impressed with Expedia For TD’s online portal for booking and redeeming points for travel (and changing a reservation or cancelling via the Virtual Assistant), and the First Class Travel Visa Infinite’s x8 points multiplier on Expedia for TD bookings. For heavy Expedia users, it’s an attractive addition to a credit card portfolio.

I’ve been impressed by recent promotional offers with annual fee waivers and sign-up bonuses of up to 135,000 points. It demonstrates that TD is interested in attracting new customers. To keep them, TD could be more creative with additional travel benefits. Following Scotiabank’s lead in eliminating the 2.5% fee on purchases in a foreign currency would be a welcome start.

TD needs to increase the value of Book-any-Way redemptions, and introduce an online system for applying points against those purchases. While the Scene+ coding system for travel purchased from other providers isn’t perfect, their system is capable of presenting the vast majority of travel purchases to users for redeeming points online. TD needs to craft an online redemption system that’s as user-friendly as their booking system.

As a fixed value program, TD Rewards can’t match the value achievable with programs such as Aeroplan, British Airways’ Avios, and other frequent flyer programs. But, with the extensive inventory of travel products bookable at Expedia For TD, and the range of travel expenses redeemable as Book any Way travel, it can certainly occupy a very useful secondary corner of a diversified miles-and-points portfolio.

If you found this post helpful, please share it by choosing one of the social media buttons. Also, what do you think of the TD Rewards program? Please add your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- How to use Scene+ points to reduce travel costs

- How to use CIBC Aventura points to reduce travel costs

- When a no-FOREX-fee credit card isn’t the best travel choice

- Polaris review of United Airlines’ lounge and in-flight experience

- Is the BMO Air Miles World Elite MasterCard a good deal?

- 9 Effective ways of meeting Minimum Spend Requirements

Pin for later?

I’m curious if the prices are jacked a bit through the TD Expedia site.

For example, I looked at the Park Lane Hotel in Manhattan. For a five night stay in a 1 Queen Bed City View room, , TD Rewards Expedia site said it would be $2222.97, all taxes, fees all in. Looking at the same room through hotels.com or Trivago, I got the same room, all in price of $1723.72/$1743 respectively. When I apply my current Rewards amount of $836 against the $2222.97, I’m left paying $1386.97, which is only around $336 less, even though I used $836!

Is Expedia always more expensive? I looked at more than a few other hotels and they are all much cheaper on hotels.com and Trivago.

Thanks for dropping by. While I never experienced price differences between Expedia and Expedia For TD, some people have reported differences, both in inventory and prices. I’ve just done a search for a five-night stay at the Park Lane Hotel in Manhattan (October 12 to 17) and found the same price at Expedia, Hotels and Booking. I couldn’t access Expedia for TD as I no longer have a TD Rewards credit card. Each of the three sites showed a regular price of $466/$468 and a discounted price of $372 for a total price of $1860. It sounds as though Expedia for TD hasn’t adjusted the regular price yet. What I would do is call Expedia for TD and ask them to match the Expedia price (if that’s what you find for your dates on expedia.ca). Good luck!

Excelent article!

Can you clarify when you got the $100 credit? The “in a calendar year” part confuses me. If I booked accommodations via ExpediaForTD over $500 for the first time this year (March 2023), will I get the $100 travel credit right away? within this year? or Jan 2024?

Hi Crystal. My $100 credit posted on January 10, 2023, the same day as my $500+ purchase at Expedia for TD. Because the TD Rewards Program Terms and Conditions specify the “first Eligible Travel Credit Purchase posted to the Account in a calendar year,” my interpretation is that I won’t be eligible for another $100 travel credit until January 1, 2024.

Anne Betts recently posted…When travelling the world on miles and points, is the TD Rewards program worth it?