Updated April 1, 2024

What are the various ways to use CIBC Aventura points to reduce travel costs? Is the Aventura program worth it? How does it work? What’s an Aventura point worth?

Here is my review as it relates to funding travel.

Table of Contents

- What is the CIBC Aventura program?

- How are Aventura points earned?

- Can Aventura points be converted to another program?

- How can Aventura points be used?

- What’s an Aventura point worth?

- How to use CIBC Aventura points to reduce travel costs

- What’s to like about the CIBC Aventura program

- Shortcomings of the CIBC Aventura program

- Conclusion

What is the CIBC Aventura program?

CIBC Rewards is the in-house propriety program of the Canadian Imperial Bank of Commerce (CIBC). The reward currency is commonly referred to as Aventura points.

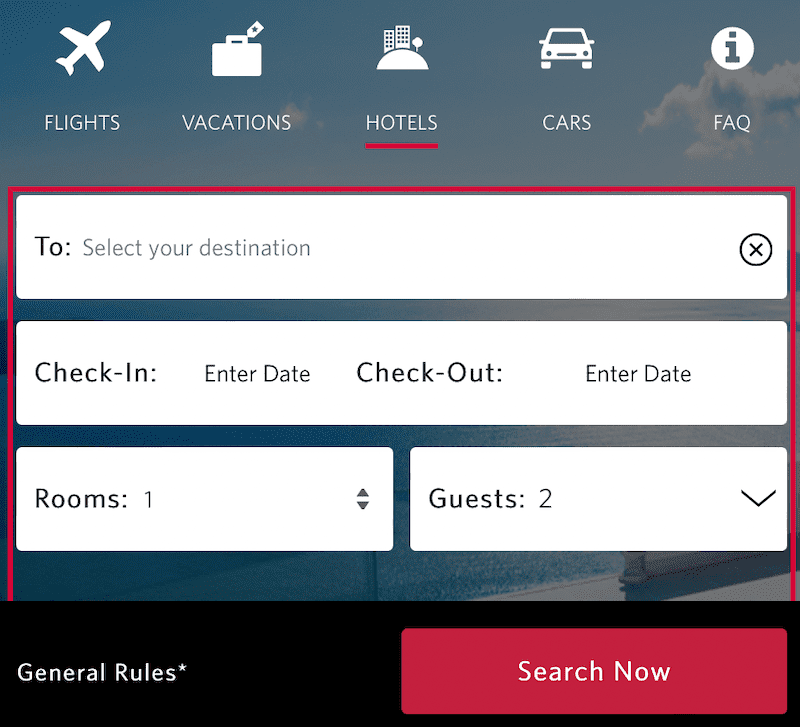

The CIBC Travel Rewards Centre is CIBC’s in-house travel portal. It’s operated by Merit Travel Group, an independent travel agency.

How are Aventura points earned?

Aventura points are earned through credit card sign-up bonuses and everyday spending. Depending on the credit card, bonus points can be earned on promotions, bookings at the CIBC Travel Rewards Centre, and spending in accelerated earning categories such as groceries, gas, and dining. CIBC has ten Aventura-branded credit cards:

- CIBC Aventura Visa Card

- CIBC Aventura Gold Visa Card

- CIBC Aventura Visa Infinite Card

- CIBC Aventura Visa Infinite Privilege Card

- CIBC Aventura Visa Card for Students

- CIBC U.S. Dollar Aventura Gold Visa Card

- CIBC Aventura Visa Card for Business

- CIBC Aventura Visa Card for Business Plus

- *CIBC Aventura World Elite MasterCard

- *CIBC Aventura World MasterCard

*CIBC MasterCards are no longer available to new applicants.

Aventura points don’t expire if an Aventura-earning credit card account is in good standing. The primary cardholder can pool points by moving them from one Aventura-earning credit card account to another.

Can Aventura points be converted to another program?

Contrary to what you might read on the internet or be told by a seller at an airport kiosk, Aventura points cannot be converted to Aeroplan (except in special circumstances). They were before CIBC co-branded Aeroplan cards were transferred to TD in 2014, when the ability to convert Aventura points to Aeroplan was discontinued. However, grandparenting protection remains in place for cardholders of three select cards held since before October 1, 2013:

- CIBC Aventura World Elite MasterCard

- CIBC Aventura Visa Infinite Card

- CIBC Aventura Gold Visa Card

Aventura points earned since then can be converted, if they have been moved to the card held before 2014. Conversion is at the rate of 1:1 and points can only be converted in increments of 10,000.

How can Aventura points be used?

Aventura points can be redeemed for travel, gift cards, donations, merchandise, experiences, credit card statement credits, or contributions to various CIBC financial products.

What’s an Aventura point worth?

As with most reward programs, travel purchases usually return the best value. On most travel redemptions, Aventura points are capable of a value anywhere between 1 and 2.2 CPP (cents per point). Most travel booked through CIBC’s in-house travel portal returns a value of 1 CPP. When booking ‘Flight Rewards’ using CIBC’s Aventura Flight Rewards Chart, some redemptions offer a return of up to 2.2 CPP in value.

Credit Card Genius has calculated the value of Aventura points when redeemed for purposes other than travel. For example, charitable donations are valued at 1 CPP, CIBC financial products and statement credits at 0.83 CPP, gift cards at 0.71 CPP, and merchandise at an average of 0.71 CPP.

Occasional promotions on gift cards can return a redemption value of 1 CPP.

How to use CIBC Aventura points to reduce travel costs

There are three ways to redeem Aventura points for travel.

1. Flexible Travel Reward

A ‘Flexible Travel Reward’ applies to online bookings for flights via the ‘Flex Travel’ option on the Aventura Flight Rewards Chart or through online or telephone bookings at the CIBC Travel Rewards Centre.

Unless there is a promotion in effect, this option returns a value of one cent per point, considered the baseline value for most proprietary reward programs’ travel purchases.

Redeeming a Flexible Travel Reward involves booking through the CIBC Travel Rewards Centre and applying points to the purchase. It doesn’t apply to bookings through other suppliers.

Check for promotions in effect at the CIBC Rewards site. In the past, there have been auctions, accelerated earning rates on travel bookings, and flights for fewer points.

2. Flight Rewards

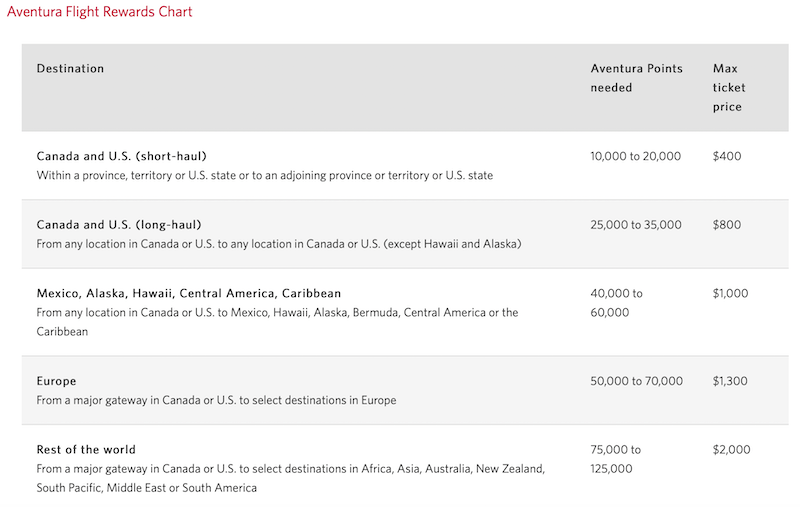

Flight Rewards are based on the Aventura Flight Rewards Chart for round-trip flights in various cabin classes, from basic economy to first class. Each group of regionally based destinations displays a sliding scale of points required for flights with a maximum base ticket price. The base ticket price is exclusive of taxes and other charges.

A greater value (than one cent per point) is possible with these redemptions the closer the cost of a flight is to the maximum ticket price listed on the chart. For example, the Canada and US (Long-Haul) travel region category shows a maximum ticket price of $800. Paying 35,000 points for a ticket with a base fare of $800 returns a value of 2.2 cents per point.

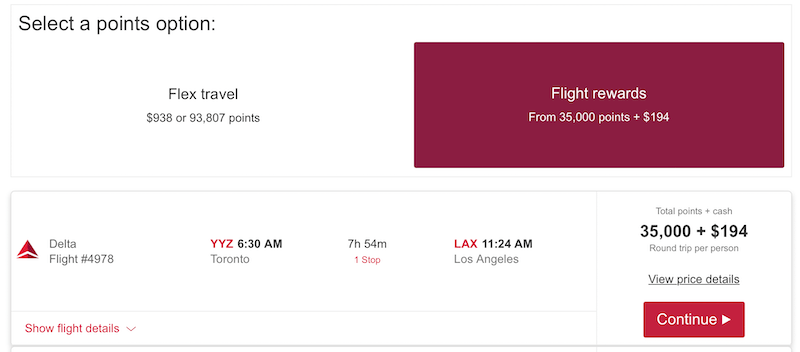

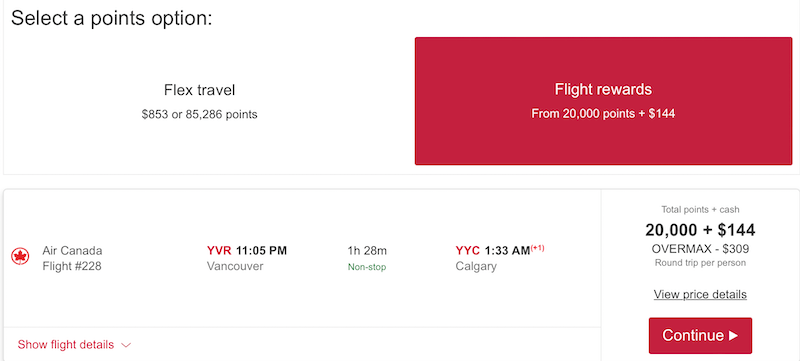

In the following example, a return flight in premium economy from Toronto to Los Angeles costs 35,000 Aventura points plus $194.07 in taxes and fees using the Flight Rewards option. Taxes and fees can be paid in any combination of points (at a value of one cent per point) and cash (charged to a credit card). If the traveller pays in points, the total would be 54,407.

In the same example, the Flex Travel option (at a value of one cent per point) shows a base fare of $744 for a total cost of $938, including taxes and other charges or 93,807 Aventura points.

By choosing the Flight Rewards option in this example, the traveller has achieved a value of 2.1 cents per point on the base fare and saved 39,400 Aventura points compared to the Flex Travel option.

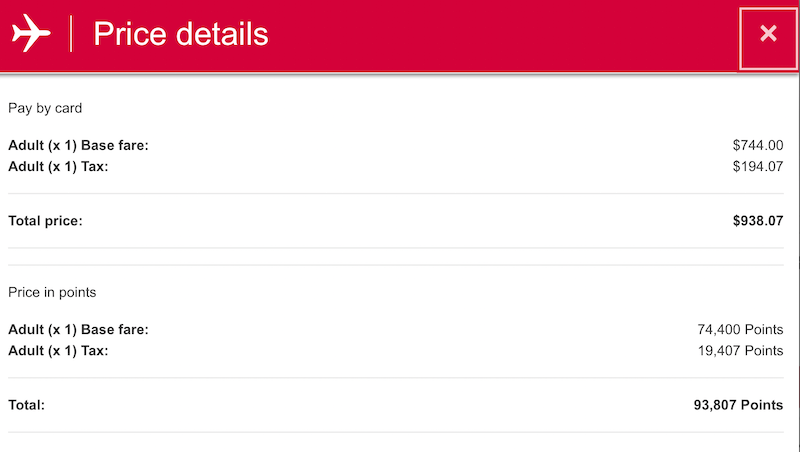

Any excess cost over the maximum ticket price can be paid for in cash or points (at a fixed value of one cent per point). As shown in the following example of a round-trip business class flight from Vancouver to Calgary, the excess appears as ‘OVERMAX’ in the search results.

The Aventura cardholder must have at least 80% of the points required to obtain the desired flight, and tickets are non-refundable unless advised otherwise. As the CIBC Travel Rewards Centre is the booking agent, any irregularities related to flight cancellations or ticketing errors will require their intervention, as opposed to the airline. Such is the dilemma of travellers who use third-party booking agencies.

3. Shopping with Points

‘Shopping with Points’ involves booking through vendors other than the CIBC Travel Rewards Centre. Until a 2022 promotion, the rate of 8,000 points on each $50 purchase worked out to an abysmal value of 0.625 cents per point. The promotion doubled the value of 8,000 points to $100, or 1.25 cents per point. After several extensions with expiry dates, the promotional redemption rate has been extended indefinitely.

Redeeming points for travel purchases using the Shopping with Points option involves the following steps:

(i) Book and pay with your Aventura-earning credit card

Make a travel purchase such as a flight, vacation package, cruise, hotel stay, or car rental at a vendor of your choice using a credit card earning Aventura points. The charge must be in Canadian dollars. I made the mistake of making a direct booking at Palmers Lodge, a London hostel, that never appeared on my account as eligible for redemption. When I booked Edinburgh and York accommodation at Expedia dot ca, both appeared almost immediately as redeemable with points.

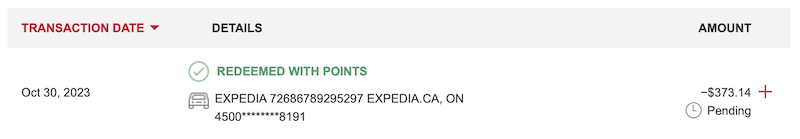

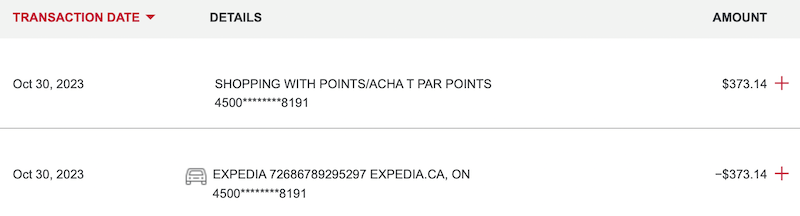

(ii) Log into CIBC Online Banking and your credit card account

Log into CIBC Online Banking (or mobile banking) and search for the transaction under ‘Pending’ in your transaction history. Chances are the charge will appear as soon as the booking has been confirmed. However, it could take a few days to post, so keep checking back.

(iii) Redeem with points while the transaction is pending

Click on ‘Redeem with Points’ (the link to redeem with points needs to be active on the transaction). If it’s an eligible travel purchase, the required points will automatically be reduced by 50% under the extended promotion. If the redemption is successful, confirmation will immediately appear within the credit card account.

The credit will be posted to the respective credit card account within two business days.

This redemption option is only available while the purchase is still pending. The Shopping with Points Terms and Conditions state that it’s non-refundable, non-exchangeable, and non-transferable. Therefore, making a refundable booking with the vendor is always preferable. Many miles-and-points enthusiasts turn Aventura points into cash with refundable bookings. Others use them to reduce travel costs.

What’s to like about the CIBC Aventura program

- Depending on the credit card, CIBC offers travel perks such as lounge access through the Visa Airport Companion Program membership and passes, NEXUS fee rebates, and an attractive Mobile Device Insurance benefit.

For more information on the NEXUS program, see Is a NEXUS card worth it? and How to apply for a NEXUS card.

- There are regular first-year-free promotions where the annual fee is waived for the first year. Many come with improved sign-up bonuses. In addition, it pays to check rebate and affiliate sites such as Great Canadian Rebates for elevated sign-up bonuses when applying through their portal.

- It’s possible to hold more than one credit card of the same type (e.g., more than one Aventura Visa Infinite) at the same time. CIBC can be quite generous with approvals.

- CIBC is more likely than other banks to waive the annual fee on request. It may also be possible to obtain a prorated annual fee refund when cancelling or product switching a credit card.

- The redemption value of a ‘penny a point’ is easy to understand. The system calculates the exact amount with no sliding scale or topping upwards. My one-way flight from Cairns to Brisbane on Virgin Australia cost $129.08, translating into a precise redemption of 12,908 Aventura points.

- There’s a no-fee card in the Aventura family (CIBC Aventura Visa Card). Applying for, or product switching to the no-fee card, can help preserve a relationship with CIBC. It can also serve a useful purpose by protecting existing Aventura points in an account between applications for other cards. However, partial redemptions (part points, part cash) offer the means to use all Aventura points with no ‘orphan points remaining in an account.

- Aventura points can be transferred from one account to another in the Aventura family. This applies to accounts held by the same cardholder. The process is efficient and instantaneous. For holders of the CIBC Visa Infinite Privilege card, it can be done online. For cardholders of other cards, contact the CIBC Rewards Centre to execute the transfer. Unlike TD Rewards, where a minimum of 10,000 points can be transferred, any number of points can be moved from one account to another. The transfer is instantaneous.

For more information on the TD Rewards program, see How to use TD Rewards points to reduce travel costs.

Shortcomings of the CIBC Aventura program

- Online bookings are limited. For example, online flight searches are limited to those originating in Canada or the USA. Calling the Travel Rewards Centre is inconvenient and can be costly when trying to make a booking from another country.

- The Aventura Flight Rewards Chart applies to return flights. One-way flights can only be redeemed as a ‘Flexible Travel Reward’ at a value of one cent per point.

- Rewards are non-refundable, non-exchangeable, and non-transferable. With the exception of refundable bookings with vendors where the pending charge is redeemed with points, there are no refunds on any travel purchased with Aventura points.

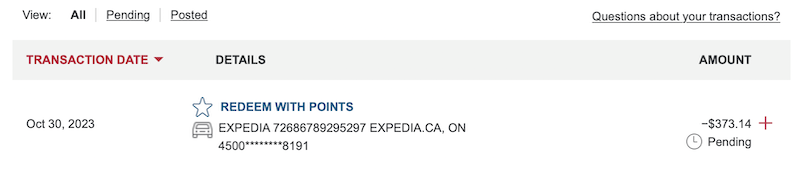

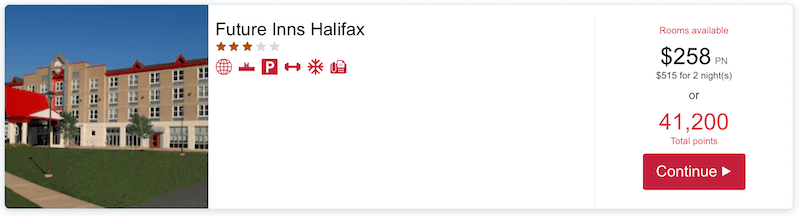

- Hotel prices at the CIBC Travel Rewards Centre can be seriously inflated. For a booking via Expedia and redeemed using ‘Shopping with points,’ I paid $373 for a two-night stay at a Halifax hotel. The same hotel with the same dates at the CIBC Travel Rewards Centre, researched within minutes of each other, revealed a cost of $515.

- Other than redeeming points while a charge is pending, there’s no post-purchase option to redeem points against existing reservations or previous travel purchases.

Conclusion

The inability to convert Aventura points to other programs makes them less valuable than reward currencies such as AMEX Membership Rewards and RBC Avion Rewards, which can be converted to reward programs where it’s possible to extract much greater value.

Aventura points can be a beneficial reward currency in a diversified miles-and-points portfolio. When viewed as a secondary program along with, for example, TD Rewards and Scene+, they can reduce travel costs by funding miscellaneous travel expenses. These include train and ferry tickets, boutique hotel stays, flights with regional airlines, tours, and various travel experiences.

CIBC is to be congratulated for extending the promotion with an elevated redemption value through Shopping with Points. It significantly increases the value of the program.

Might you be interested in my other miles-and-points posts?

- How to use Scene+ points to reduce travel costs

- How to use TD Rewards points to reduce travel costs

- Is a no-FOREX-fee credit card always the best choice for international travel?

- Finding Aeroplan flights: a step-by-step guide

- Meeting Minimum Spend Requirements to travel the world on miles and points

- Lounge and flight review of United Airlines’ Polaris experience

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

- Why the Best Western loyalty program is good for travellers

- What is the best credit card for trip cancellation, trip interruption and flight delay insurance for trips on points?

Care to pin for later?