Updated July 12, 2022

Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet? According to Credit Card Genius, it’s the best Air Miles credit card on the market. If most of the following features appeal to you, it certainly deserves some consideration.

Table of Contents

- 1. First year Free (FYF)

- 2. Sign-up bonus of 2,000 Air Miles

- 3. Air Miles (Dream Miles) can be useful for travel

- 4. A decent MasterCard is handy to have

- 5. Limited 25% discount on flight redemptions

- 6. Earning rates between 1 and 3 mile(s) for each $12 spent

- 8. Airport lounge access

- 9. A full suite of insurance benefits

- A few other features…

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

1. First year Free (FYF)

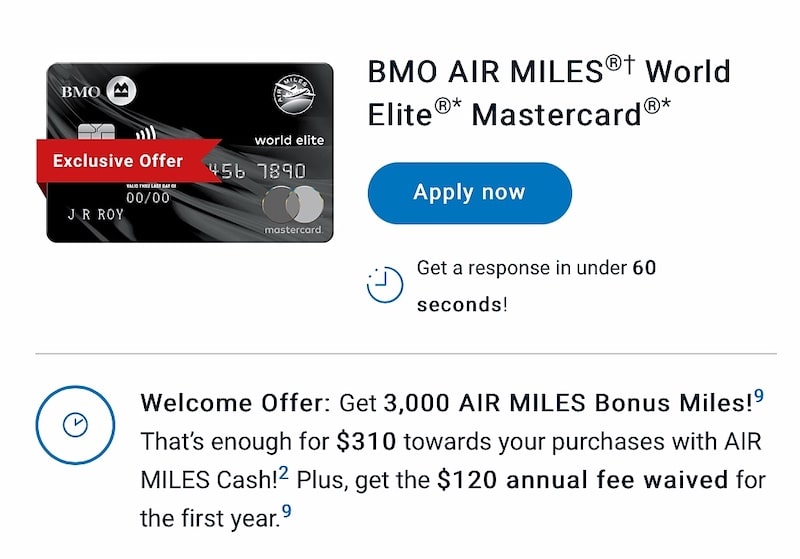

The current ‘Offer Period’ from May 1, 2020 to December 6, 2022 includes an annual fee waiver ($120) for the first year. The fee appears as a charge on the first statement, accompanied by a credit for the same amount. A FYF promotion and an attractive sign-up bonus are key features of a tempting credit card offer.

2. Sign-up bonus of 2,000 Air Miles

The sign-up bonus of 2,000 miles has a $3,000 Minimum Spend Requirement (MSR) within the first three months.

However, it’s worth looking around for better than the public offer appearing on the BMO site. For example, Credit Card Genius has an offer with a sign-up bonus of 3,000 Air Miles when using its application portal.

A sign-up bonus of 2,000 miles is enough to redeem for at least one short return flight. A sign-up bonus of 3,000 miles could be redeemed for a medium-haul return flight.

If you like to have a healthy cushion of Air Miles in your portfolio, this offer allows you to rack up over 3,000 Air Miles within a short period. The average collector takes years to accumulate anywhere near this amount.

3. Air Miles (Dream Miles) can be useful for travel

Air Miles get a bad rap in some miles-and-points circles. They’ll never lead to a suite or shower in the sky. Those luxuries are the stuff of frequent flyer programs offering redemptions in first or business class cabins. Air Miles is a poor cousin occupying a small, but useful corner of a diversified miles-and-points portfolio.

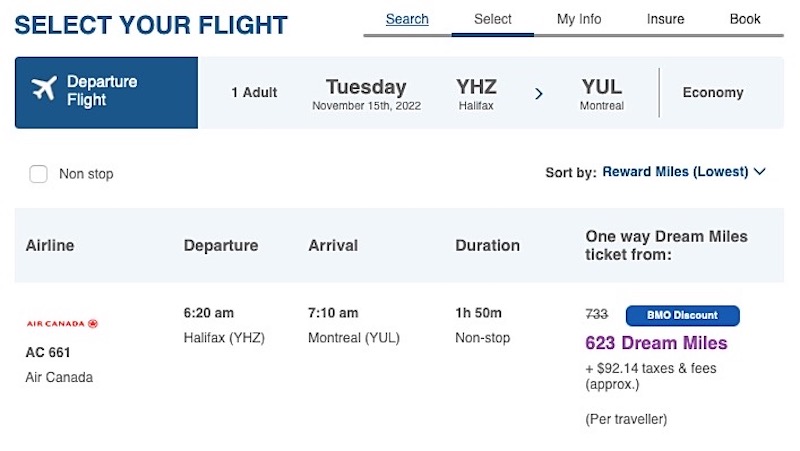

For those of us with ‘hub-envy,’ they can be beneficial for short positioning flights to hubs served by airlines with other (and better) frequent flyer programs. For example, to redeem Avios points for a business-class Q-suite redemption with Qatar Airways, I could use Air Miles for a positioning flight from my home airport of Halifax to Montreal or New York.

Air Miles can be redeemed for a variety of travel expenses including vacation packages, cruises, hotels, and car rentals.

4. A decent MasterCard is handy to have

I love American Express. But, let’s face it, there are places where AMEX cards aren’t accepted and it’s handy to have a decent Visa and MasterCard in your wallet.

It’s not always an easy choice to switch to AMEX-accepting merchants. When you’ve established a relationship with health care providers such as dentists and optometrists, or a history with insurance agents or a legal firm, it’s an easier choice to simply pay with Visa or MasterCard (if that’s what they accept). That’s certainly my dilemma, and more so because I live in a rural community where options are limited.

And then there’s the in-store MasterCard-only policy of Costco.

Another dilemma concerns the MSR. It’s higher than that of many premium credit cards. For many people, it’s achievable by switching everyday spend to the card for the first three months. One disadvantage of doing so is that your other miles-and-points programs don’t benefit from a $3,000 spend. It’s a more difficult choice if it means missing out on one or two other attractive sign-up bonuses because you’re diverting such a significant spend to this one card.

The BMO Air Miles World Elite MasterCard is an easier choice when:

- There are expenses within the first three months with merchants that don’t accept American Express (but they do accept MasterCard).

- You regularly shop at Costco. If you come up short in meeting the minimum spend, consider investing in one or more Costco Shop Cards to use on future visits.

5. Limited 25% discount on flight redemptions

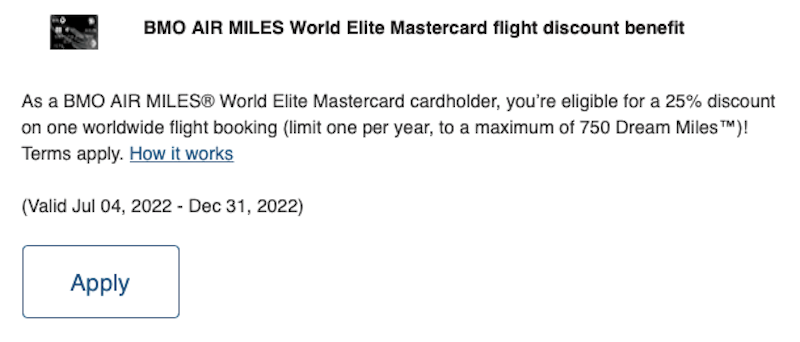

Back in 2017, BMO devalued the BMO Air Miles World Elite Mastercard flight benefit from a 25% discount to 15%.

Effective July 4, 2022, the flight redemption discount changed yet again. BMO Air Miles World Elite MasterCard cardholders now receive a 25% discount on one worldwide flight booking per calendar year, up to a maximum of 750 Reward Miles. This replaces the previous 15% discount flight benefit and can be spread across all tickets on the booking. To take full advantage of the discount, the combined cost of all flights on the booking would need to amount to 5,000 miles.

While the 15% discount was limited to North American destinations, the updated flight discount now provides cardholders with an additional 10% savings available on flights anywhere in the world. You don’t need to use your card to pay the taxes and fees to be eligible for the discount.

The option to use the flight discount benefit appears during the booking phase once flights have been chosen.

6. Earning rates between 1 and 3 mile(s) for each $12 spent

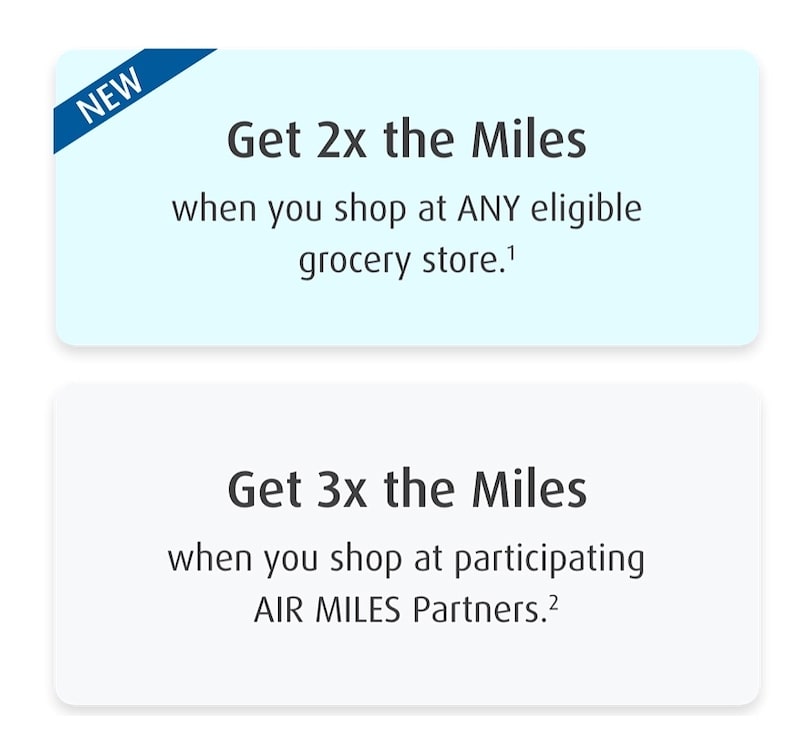

On each $12 spend, the base earning rate of 1 mile increases to 2 miles at non-affiliated grocery stores (effective August 1, 2022), and 3 miles at participating Air Miles partners.

The 2x reward miles earned at participating National Car Rental and Alamo Rent-A-Car locations was discontinued effective June 1, 2022. Savings of up to 25% on rentals at participating locations remain in effect.

Accumulating Air Miles based on organic spend can be a long and tedious journey. Credit card sign-up bonuses and points-boosting promotions are the best ways to accelerate earning rates. Newsletters from Air Miles will keep you abreast of points-boosting promotions.

By stacking promotions, it’s possible to increase the number of miles earned on your minimum spend.

I signed up for Share the Holiday Magic, Shop the Block, Black Friday, Cyber Monday, and monthly offers from BMO and Shell. By doing so, it was possible to earn another 3,000 Air Miles from these promotions (and points in other programs from the same purchases).

UPDATE: During the latter months of 2022 and in early 2023, Sobeys, Safeway, Lawtons Drugs, and other stores under the Empire umbrella will leave the Air Miles program. Customers will earn Scene+ points beginning with Sobeys customers in Atlantic Canada in August 2022.

For more information on the Scene+ program, see What’s the best use of Scene+ (formerly Scotia Rewards) when travelling the world on miles and points?

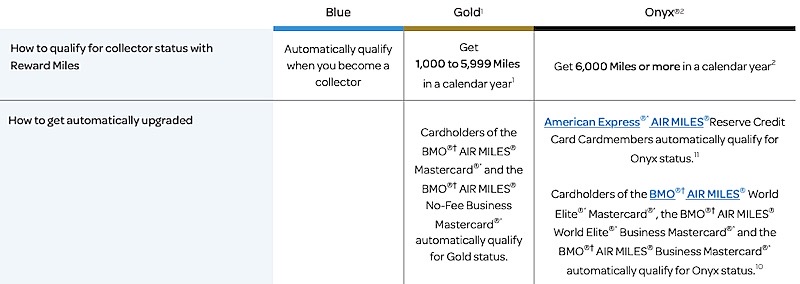

7. Automatic Onyx status

Collectors who earn 6,000 or more Air Miles in a calendar year qualify for Onyx status.

A BMO Air Miles World Elite cardholder automatically qualifies for Onyx status.

Onyx members can book select flights requiring up to 40% fewer Dream Miles. While I’ve never seen these kinds of savings, I believe Onyx status provides access to a wider inventory of flights. Other benefits include merchandise discounts of up to 10% fewer Cash Miles, and the ability to pay with cash and miles on hotel bookings.

8. Airport lounge access

The card offers a Mastercard Travel Pass membership that replaces ‘MasterCard Airport Experiences by LoungeKey.’ The Mastercard Travel Pass is provided by DragonPass that includes access to over 1000 lounges globally, including Plaza Premium Lounges. At the time of this update, it remains to be seen if BMO Air Miles World Elite MasterCard cardholders will join BMO World Elite MasterCard cardholders with four annual complimentary passes. Otherwise, each visit costs 32 USD.

Sign up with your BMO Air Miles World Elite MasterCard to receive a membership number, and download the app to display your membership card and locate lounges and offers. For more information on DragonPass, visit Prince of Travel.

9. A full suite of insurance benefits

The BMO Air Miles World Elite Travel and Medical Protection Certificate of Insurance includes coverage for:

- out-of-province/out-of-country emergency medical treatment (for cardholders under the age of 65);

- trip cancellation;

- trip interruption/trip delay and flight delay;

- baggage and personal effects; and

- car rentals.

Insurance is where this credit card shines, especially for miles-and-points enthusiasts who use their points for award travel.

Usually, to be eligible for insurance such as trip cancellation, trip interruption, flight delay, and baggage and personal effects, the points must have come from the respective program associated with the card. For example, the Scotiabank Gold American Express Card only covers trips (on points) using Scene+ (formerly Scotia Rewards). For Aeroplan redemptions, coverage is only available through one of the Aeroplan co-branded cards (e.g., with CIBC or TD). In both cases, all other award travel is ineligible.

In addition, most cards require a significant portion of the costs be paid with the respective credit card. For example, the TD Aeroplan Visa Infinite and The Platinum Card by American Express refer to the “full cost” and “entire cost” respectively. For the Scotiabank Gold American Express it’s not less than 75%.

The BMO Air Miles World Elite Mastercard is unique. Eligibility for insurance coverage for trip cancellation, trip interruption, flight delay and baggage and personal effects requires that the “full or partial costs” of a “ticket” be charged to the card. This can be a ticket with any common carrier (air, land, or sea) that’s part of a trip. It doesn’t need to be the primary ticket such as the return flight to and from your home airport. It could be a train ticket at your destination (as long as it’s booked and paid for prior to leaving your home province).

And, compared to other cards, the insurance is quite generous. For example, for trip cancellation it’s $2,500 per insured person, compared to $1,500 on the TD Aeroplan Visa Infinite, and $1,000 on the two CIBC Aeroplan-branded cards (personal and business).

The “full or partial cost” language makes Air Miles a useful currency for car rentals. Most credit cards’ auto rental insurance policies require a cardholder to charge the full cost of the rental for the insurance to apply. By redeeming Air Miles and paying the taxes and fees with the BMO Air Miles World Elite MasterCard, eligibility for insurance coverage kicks in.

If you value credit card insurance, the BMO Air Miles World Elite MasterCard is worth a close look. For a more detailed review, see What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points?

A few other features…

- It’s churnable. There’s no language limiting access to subsequent promotions and repeat sign-up bonuses. Apply on one promotion, cancel before the fee comes due, and then reapply on another promotion. However, you need to cancel before the effective date of the next promotion. You can’t cancel and reapply during the same ‘offer period’ (or transfer in from another product) and be eligible for the promotional benefits.

- Purchase protection and extended warranty covers most items purchased with the card.

- The MasterCard Global Unlimited Plan provides unlimited Wi-Fi access to Boingo hotspots around the world. Download Boingo’s Wi-Finder app for the easiest way to gain access.

- It’s easy to set up preauthorized payments from your bank account. It doesn’t need to be a BMO account. You don’t need to complete a form, visit a branch, or mail a voided cheque. Simply call the service centre and provide the number of your bank account.

- BMO deposits Air Miles into your account on or immediately after your statement date. This includes miles earned on transactions, or bonuses from meeting MSRs. This is handy to know if you’re contemplating the best date to cancel the card.

- The online application takes approximately five minutes to complete. I was approved within one minute.

- If you don’t hold another BMO credit card or you’re not a current BMO customer, chances are you’ll have to pick up your new credit card at a branch and show the required pieces of identification.

Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

It’s a worthy card to have in your wallet if you:

- don’t live in or near a major hub and use Air Miles for positioning flights

- use a variety of sources (e.g., miles, points, and cash) to fund travel and rely on the card’s excellent insurance for trip cancellation, trip interruption/trip delay, and flight delay.

Might you be interested in my other miles-and-points posts?

- Is a no-FOREX-fee credit card always the best choice for international travel

- Finding Aeroplan flights: A step-by-step guide

- Lounge and flight review of United Airlines’ Polaris experience

- Is the TD Rewards program worth it?

- What’s the best use of Scene+ (formerly Scotia Rewards) when travelling the world on miles and points?

- Why the Best Western loyalty program is good for travellers

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points?

Great article. I didn’t clearly understand the idea of cancelling & reapplying esp this issue of doing it b4 the effective date of the new promotion. Does that mean if I have a bmo elite card now acquired in the last promotion (2017/18) I can’t cancel this card to apply under 2018/19 promotion becoz it began a few months a few months ago?

If the card you have is the BMO Air Miles World Elite MasterCard, you’re ineligible for this promotion if you cancel it and reapply during the period of the offer. The T & C are clear: “Existing BMO AIR MILES World Elite Mastercard customers who cancel their card during the “Offer Period” and existing BMO Mastercard customers who transfer into this Credit Card product during the “Offer Period” are not eligible for the Offers.”

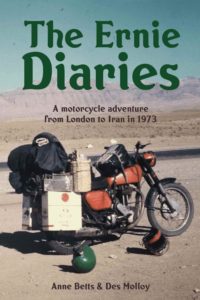

Anne Betts recently posted…25 Tips on earning Aeroplan miles

I will be 70 in May. I am planning a 30 day European trip in September 2022. I have full medical coverage through my former employer, no age limit, no maximum in medical costs. I have a BMO World Elite Airmiles card that covers trip cancellation age 65 and under. My travel agent is trying to sell me more insurance for $690 for trip cancellation….does this make any sense? Thanks.

It’s not a blanket age restriction. The age restriction applies to pre-existing conditions. Take a look at the policy at 4.3.4 to see if it applies to you. $690? That’s steep!! That kind of premium would cover at least $7,000 of non-refundable travel bookings and I would presume that some of your bookings are refundable. Keep in mind that it’s only non-refundable bookings that are covered. I find that many travel providers are encouraging folks to travel, offering bookings that are completely refundable as incentives. Here’s a link to the BMO insurance booklet: https://www.bmo.com/pdf/AM_WE_Travel_Medical_Protection_Insurance_Certificate_En.pdf

What’s the minimum spend to get the 3,000 bonus airmiles on Creditcardgenius.ca? Also if I get this card as well as the American Express Airmiles Reserve, can I double dip on the benefit? BMO offers 25% off up to 750 airmiles, while the Amex offers annual companion voucher up to 1,700 airmiles back?

The Credit Card Genius MSR was the same as BMO’s public offer: $3,000.

I haven’t seen any restrictive language limiting access to both benefits. Unlike the buddy pass, they’re different benefits.