Updated July 10, 2024

For the vast majority of credit cards, the MSR, or Minimum Spend Requirement, unlocks a SUB, or sign-up bonus — every miles-and-points enthusiast’s goal and the backbone of the hobby. Each SUB fast tracks access to free hotel stays, flying in premium cabins, and cheaper travel costs. Therefore, it’s important to have a host of strategies at your fingertips on meeting Minimum Spend Requirements.

Before applying for a credit card, especially one with a substantial MSR, it’s critical to have a spending plan.

Table of Contents

- Tips on getting organized

- Meeting minimum spend requirements

- 1. Prepay bills

- 2. Front-end load spending with gift cards

- 3. Stock up on non-perishable goods

- 4. Negotiate a higher down payment

- 5. Purchase big-ticket items for friends and family

- 6. Identify ways to spend other people’s money

- 7. Use bill-payment services

- 8. Extend your MSR window with refundable purchases

- 9. Spread payments over several cards

- Conclusion

Tips on getting organized

1. Know which cards your vendors accept

It’s well known that in Canada, the only credit card that Costco currently accepts for in-store purchases is a MasterCard. Still, it’s surprising how many people in miles-and-points forums express surprise on learning that their grocery store of choice doesn’t accept the brand-new American Express (AMEX) credit card they’ve just received.

Many vendors, suppliers, and service providers accept only Visa or MasterCard. Some don’t accept credit cards at all. Knowing who does and who doesn’t accept credit cards, and which ones, is a logical starting point when developing a spending plan.

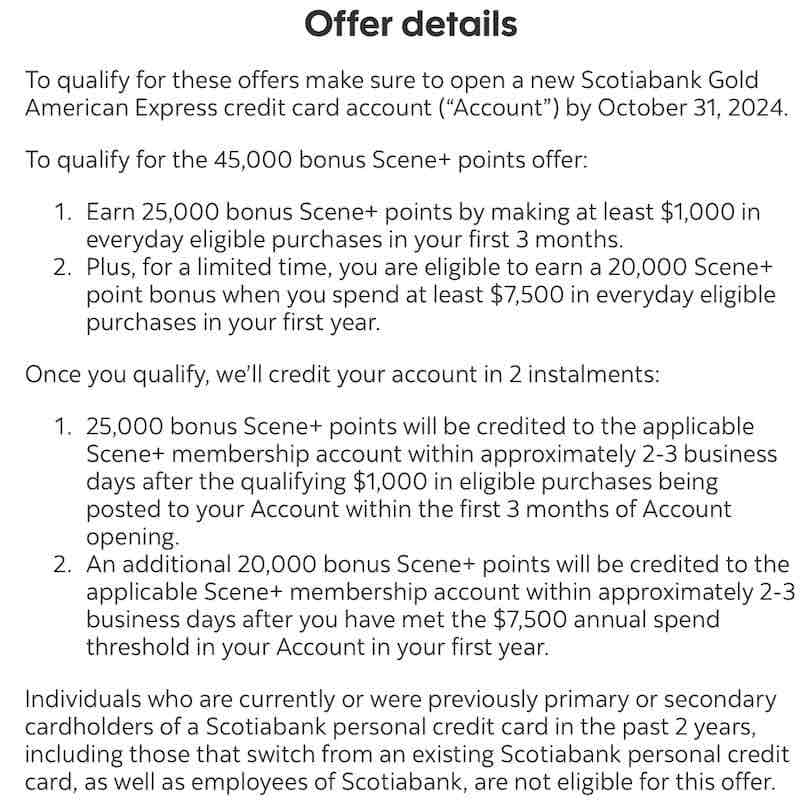

2. Check the terms and conditions

If it’s a new application, carefully read the terms and conditions for eligibility for the SUB, and other promotional features such as First Year Free (FYF). A SUB might comprise a welcome bonus and a spending bonus. Eligibility for a welcome bonus is triggered on approval or the first purchase. A spending bonus refers to the points awarded when the MSR is met.

Some card issuers don’t allow repeat sign-up bonuses or restrict bonuses to those who haven’t opened or closed that particular card within a certain period.

If you decide to apply, take a screenshot of the promotion and the key terms and conditions for your records. The promotion may disappear from the website, and a screenshot will help if you don’t receive what you expected.

For a product switch (from one credit card product to another), read the terms and conditions before requesting the switch via telephone or online chat.

Keep in mind that despite what the terms and conditions state, or what a Customer Service Representative (CSR) may say, terms and conditions on new applications and product switches might not be enforced.

3. Meet the MSR deadline with time to spare

Aim to meet the MSR date with a comfortable cushion of both time and spending, keeping these basic realities in mind:

- On a new application, the MSR window doesn’t begin when you receive and activate the card. It’s much earlier, and depending on the issuer, it starts on the application, approval, or card generation date. Leaving an application until the final day of a promotional offer could mean missing out on the promotion if the card issuer uses approval or card generation date.

- Some financial institutions add the number of the new credit card within a day or so to an online account.

- On a product switch, there’s a little-to-no waiting period to begin working on an MSR. You can keep using your old card, and it will earn points in the new points currency with the spend counting towards the MSR. Verify with the CSR, but it likely takes effect before the end of your online chat or telephone conversation on making the switch or on the following business day if the product switch takes place on a weekend.

- Make a note of the date the MSR needs to be met, and set a calendar alert backdated to include your ‘cushion time.’ One reason for building in time to spare is that charges may not post on the date you presented your card for payment. For example, if an online merchant doesn’t charge until the item is shipped, the points will be tied to the shipping date, and the order date becomes irrelevant.

- The annual fee doesn’t count towards the spend requirement. Other spending that doesn’t count towards an MSR includes refunds, cash advances, and traveller’s cheques. Check your card’s terms and conditions for details.

- Spending on a supplementary card counts towards an MSR.

- Monitor your account for both spending and bonuses. Keep in mind that some card issuers such as AMEX post the bonus when the qualifying charge passes the MSR threshold. Others might not post until the qualifying statement date or it may take several billing cycles to appear. The terms and conditions usually outline these time frames.

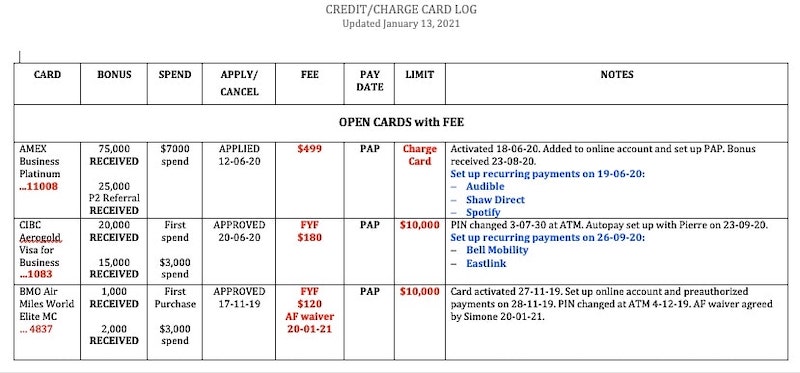

- When the SUB posts, amend your records to indicate that it has been received.

4. Beware of making a large charge

A significant charge on your new credit or charge card might trigger a fraud alert, especially if your relationship with the card issuer is new. It could result in a denial of the charge and a temporary or permanent shutdown of your card.

One possible workaround is to start using the card for smaller purchases. Or break a large expense into smaller charges and make a manual payment as soon as possible, before your statement posts. Another approach is to call your card issuer beforehand to give them the heads up on the large purchase and receive the go-ahead to use your card with assurances the charge will be processed. Again, make a manual payment without delay to keep your credit utilization rate low (below 30%).

5. Maintain a list of expenses and dates

When an attractive promotion rolls around, it’s helpful to refer to your running list of recurring and expected expenses. At first blush, a $5,000 MSR within 90 days can be daunting. In fact, when I suggested to a friend that she might want to sign up for an offer with a $5,000 MSR, she outrightly rejected it. After we listed her expenses and various means to meet the MSR, she jumped on the promotion and boosted her Aeroplan account by over 40,000 points.

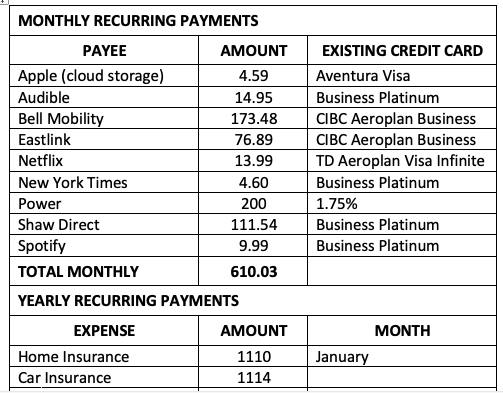

Start with year-to-year and month-to-month recurring expenses with amounts and dates. Some of these will be so substantial that they’ll kick-start a significant MSR. Or, you might see that you could easily manage more than one MSR and earn more than one SUB. Your list might include:

- annual dental and eye appointments

- accountant’s fees

- income and property taxes

- rent

- tuition and school fees

- daycare

- gym membership

- professional membership fee

- home and vehicle insurance

- car payments

- drug plan premium

- utilities such as power and water

- TV, internet, and telephone

- subscriptions such as Amazon Prime, Audible, Award Wallet, ExpertFlyer, and Microsoft Office, cloud storage, and streaming services such as Netflix and Spotify

Predict anticipated expenses by category. These include:

- health aids such as eyeglasses, hearing aids, or orthodontic appliances

- personal care (e.g., hair and spa appointments)

- health services such as prescription co-payments or chiropractic, physiotherapist, and massage therapy appointments

- veterinary care

- charitable donations

- political contributions

- transit pass

- dry cleaning

- vehicle registration, vehicle maintenance, toll pass, gas expenses

- taxi, ride sharing costs

- home maintenance, landscaping

- replacing an appliance

- upgrading electronic equipment

- birthdays, graduations, anniversaries, and seasonal celebrations

Include eats and drinks (e.g., groceries, dining, coffee, takeout, food delivery, bar, liquor store) or create a separate estimate of these costs. Most miles-and-points enthusiasts have at least one keeper card in their wallets that earns a decent points multiplier or cash back on this category. You may find that an MSR on a card without this category bonus can be met in other ways.

Develop a breakdown of predicted expenses of a significant event or project such as a:

- trip

- wedding

- family celebration

- renovation project

Add a timeline or a payment schedule for when the costs will be due. If a contractor is doing the renovations, negotiate an arrangement to purchase the supplies from the local building supply depot using your credit card. Look into setting up an account and ask for a discount on the materials charged to the account.

Maintain a running list of future purchases. These might include a small kitchen appliance, a new travel bag, a recommended book, or a shopping list for the next Costco run. I find a Notes app works well. Add possibilities as soon as the idea strikes. It’s surprising how these add up and can meaningfully contribute to a minimum spend. An added advantage is that it can reduce impulse spending. Also, because items remain on a list for some time, many can be purchased on sale or as part of a points-earning promotion. Keep shopping portals in mind to earn extra points.

The information gleaned from these lists will help you be strategic about the optimum times to stagger credit card applications and product switching strategies. If you have a list of cards that interest you, when it’s time to make a considerable purchase (or several purchases of lesser value), you’ll be ready to sign up for one of the cards that interest you.

6. Use a credit card for almost all expenses

If it’s for a purchase of 50 cents or 50 dollars, pay by credit card. If you’ve been paying bills by cash, debit card, or bank transfer, shift to credit-card mode where possible. Examine your lists for opportunities to switch. If you set up recurring payments, it’s one less task to worry about. For a substantial spend requirement, consider making your new card the default payment method until you meet the MSR. You might miss out on earning multiplier bonuses on grocery and gas purchases for a few weeks, but the value of the SUB will inevitably outweigh the value of the points you might earn on category spending.

Meeting minimum spend requirements

Many of these strategies are premised on having enough funds to float for upfront spending against future expenses. Going into debt defeats the entire purpose of accumulating points to save money on travel costs. Rethink your involvement in the miles-and-points hobby if you’re paying credit card interest at exorbitant rates because you can’t pay your credit card balance in full (and on time) every month.

1. Prepay bills

Prepay for services you won’t be cancelling soon. These might include rent, power, streaming services, telephone, internet, and television.

If, for example, you make a lump-sum payment in advance for six months of power bills, the amount owing on each statement will be deducted from your credit balance.

You could also pay bills earlier, rather than waiting for the annual notice. If your vehicle insurance comes due in December, you could pay it in September to help meet or wipe out a pending MSR.

2. Front-end load spending with gift cards

Purchase gift cards for gas, groceries, and retailers and suppliers you support. Earning power is boosted if you purchase the gift cards at a grocery store, gas station, or drug store using a credit card with a points multiplier for the respective location.

If credit card extended warranty protection is an important consideration for purchases such as appliances and electronic equipment, keep in mind that gift cards won’t trigger eligibility for insurance coverage. The same might hold true for certain types of travel insurance if you’re obligated to put the full costs of the trip on the credit card in question.

Check out the vast array of gift cards on the gift-card racks at your grocery store and watch out for deals. Savings can also be realized by buying gift cards at online sites such as My Gift Cards Plus, Rakuten, or Swagbucks. For online accounts such as Amazon, iTunes, Netflix, Starbucks, and Tim Hortons, purchase the relevant gift card and load it to your account. Keep in mind that the purchase or redemption of gift cards might not qualify for a promotion through an online portal. Read the terms and conditions of the promotion before proceeding.

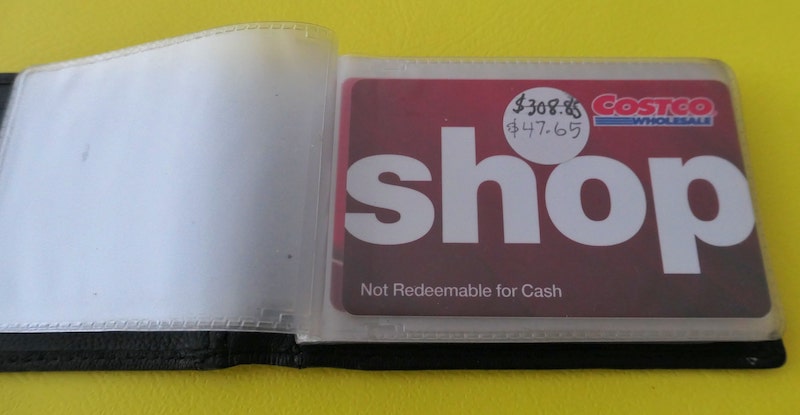

For Costco in Canada, purchase Costco Shop Cards (physical or digital) online with either a Visa or MasterCard and use the shop cards as in-store currency. Denominations vary between $50 and $2000. Only members can purchase Costco Shop Cards, but they can be used by both members and non-members. Perhaps you have family members or friends who don’t see the value in a Costco membership, but they’d appreciate the occasional shopping trip to Costco. Purchase them a shop card and get reimbursed in cash. Non-members can use a shop card if they register for a one-day shopping pass at the Membership Counter.

Another option is to buy a prepaid Visa or MasterCard gift card at a points multiplier location then use it for non-category organic spend where the earning power is typically one point per dollar (e.g., insurance, legal fees) or at a location that doesn’t accept AMEX. There’s an activation fee of $9.95 on a $500 card, but the value of the MSR could offset it. The challenge lies in finding cards with a high enough denomination to make it worthwhile.

Keep the following tips in mind when purchasing and redeeming gift cards.

- Keep gift cards secure, and treat them as financial cards. You may have a sizeable collection so find a system that works for you. I find a gift card wallet helpful. It has individual see-through leaves for organizing cards alphabetically by vendor.

- A pocket in the wallet stores self-adhesive dots from a dollar store to attach to each card to record its balance. Additional pockets store activation details on the vendor’s receipt at the time of activation. Write the name of the gift card (e.g., Canadian Tire) on the activation details and keep it until that card is first presented for redemption. If a $100 gift card purchased at a grocery store shows a balance of $0 when you first present it at Canadian Tire for redemption, your activation receipt will be invaluable when you return to the grocery store to have the flawed/fraudulent card replaced.

- When meeting a minimum spend, resist any temptation to wipe out the card’s MSR by buying a fistful of gift cards. It’s a common practice of fraudsters to use stolen credit cards in this way. Space out your gift card purchases and mix them with other spending. Otherwise, a large purchase might trigger fraud alert systems and lead to a cancellation of the card.

- Be especially vigilant when buying Visa and MasterCard Gift Cards in a store. Purchasing from a customer-service counter is less risky than buying one displayed on the free-standing gift card rack where fraudsters can more easily tamper with the cards. Look for evidence of tampering such as damage on the seal on a barcode. Register your card online without delay and keep your activation receipt just in case.

3. Stock up on non-perishable goods

Review flyers for savings and limits on quantities and stock up on products you use, paying close attention to product expiry and best-before dates.

Stay abreast of promotions involving other loyalty programs to combine meeting an MSR with earning bonus points in other programs.

If your local merchant doesn’t accept a particular card (e.g., AMEX), investigate workarounds. For example, the Foodland in my community doesn’t take AMEX but the Sobeys store 50 kilometres away does. I can purchase Sobeys gift cards and use them to shop at Sobeys, Foodland, Fresh Co., Lawtons Drugs, Safeway, IGA, Thrifty Foods, and Needs. (Also, I’ve used a Sobeys gift card to purchase other gift cards but this practice may vary from store to store.)

4. Negotiate a higher down payment

A $5,000 down payment by credit card has been accepted by my local dealership on the purchase of a new vehicle.

Try negotiating a higher down payment using a credit card. You might need to suggest that you’ll pay the merchant fee if you think it can be offset by the value of the spending bonus.

5. Purchase big-ticket items for friends and family

Pay for the purchase of a camera or an appliance for someone else with your credit card and be reimbursed in cash. The deal is sweeter for the new owner if the credit card you use has extended warranty coverage. The manufacturer’s warranty on the product can be extended by one or two years depending on the credit card.

6. Identify ways to spend other people’s money

Chances are you have friends, family, and co-workers who are happy to have you organize an activity and reimburse you for the costs. Or, you have family and friends who aren’t interested in chasing points but will support your endeavours. Here are some examples.

(i) Travel bookings

Not everyone in a travel group has the time or interest to plan a trip. If you’re the exception, do the legwork, consult with others on decisions, make the bookings, pay by credit card, and send out an itemized list of charges for reimbursement.

- Pick up the tab at restaurants or pay for purchases on shopping excursions for family and friends. Pay your roommate’s share of the rent. Order products in bulk and split the costs. One way to keep track of what you’re owed is to add the expense to Splittr or a similar group-sharing app. Splittr allows you to enter a cost incurred by just one person or one that needs to be split with one or more members of a group.

(ii) Gift cards

A friend has an arrangement with several family members to supply them with grocery and gas gift cards for everyday use. She buys the cards and exchanges them for cash, at face value.

(iii) Supplementary cards

For one or more trusted family members, apply for supplementary cards in their names to use for their spending. Many supplementary cards don’t have a fee attached. The account will be in your name, they’ll be authorized users, and you’ll be liable for all charges. Their charges will appear separately on the monthly statement, so it’s easy to identify how much you’re owed by each person.

(iv) Employment expenses

Booking and paying for your employment-related travel and submitting an expense claim for reimbursement is a common practice. But are there other expenses currently billed directly to the employer that might lend themselves to reimbursement? Perhaps some of these expenses (e.g., health care expenses, professional fees) could be paid by credit card and then submitted for reimbursement.

(v) Lottery pools

Lottery pools are common within workplaces, or among groups of friends. They can be lucrative points-earning opportunities for the person who’s willing to take on coordination responsibilities. Depending on the point of purchase (and how the purchase is coded), buying lottery tickets by credit card could be regarded as a cash advance by the card issuer. If so, it would attract interest charges and a cash advance fee (usually $5). This will inevitably be the case for purchases from the provincial gaming corporation or an independent lottery booth.

Lottery tickets purchased from grocery stores fall under a general merchandise code and are not considered a cash advance or ‘cash-like transaction.’ For what it’s worth, this has been my experience for several years. If in doubt:

- Check your cardholder agreement for language similar to this from BMO: “cash-like transactions mean transactions involving the purchase of items directly convertible into cash including wire transfers, money orders, traveller’s cheques, gaming transactions (including betting, off-track betting, racetrack wagers, casino gaming chips, and lottery tickets)

- Buy one lottery ticket with your preferred card at your preferred location and wait for it to post to your account. If your preferred location was a grocery store and there was no cash advance fee, you’re good to go.

On a related matter, share your loyalty cards with family and friends who aren’t interested in having their own account. For those with a Smartphone, add your loyalty card to their loyalty card wallet app. My favourite is Stocard. For those who prefer a physical card, order extra copies for them.

7. Use bill-payment services

Some suppliers, institutions, and government agencies don’t accept credit cards. A workaround is that perhaps they’ve partnered with a third-party payment service. The payment service will process your credit card payment for a fee and send a cheque or bank transfer on your behalf.

For example, my municipality uses Paymentus to process property taxes for a fee of 1.75%. The provincial power corporation uses KUBRA EZ-PAY for a fee of 1.75%. PaySimply (2.5%) and Plastiq (2.9% or 2.49% for Canada Revenue Agency) perform a similar service. Not all payment options are available for all billers; check each payment-service site for details.

8. Extend your MSR window with refundable purchases

If you’re comfortable dabbling in refundable purchases, one way of extending your MSR window is to make a purchase that contributes in a meaningful way to meeting your MSR. Then, once you’ve passed the MSR threshold with other spending, apply for a refund of the refundable product or service.

Of course, you’d need to purchase the product or service from a service provider or retailer with liberal refund policies and follow them to the letter. However, I have a few suggestions:

- Don’t make the refundable transaction the one to trigger the bonus. For example, let’s say you’re chasing a $7,000 MSR. If you make a fully refundable hotel booking at Expedia costing $2,000, don’t do so after you’ve already spent just over $5,000 as the hotel booking will be the one that puts you over the threshold. It may (or may not) alert the card issuer’s system to generate a claw back of points when the refund is processed.

- Double-check that the listed price is in your home currency. Otherwise, you might be dinged FX (foreign exchange) fees on both the payment and refundable sides of the transaction.

- Have the online purchase of a refundable item shipped to the retailer’s store where you can pick it up and open it in the presence of store staff. This is particularly important for an item such as jewellery or electronics with the potential to disappear during packaging or shipping. I know someone who purchased a $1,000 watch delivered to his home only to find a box without a watch inside. Obtaining redress from PayPal and the retailer was a nightmare.

While on the subject of refunds, for in-store returns, it might be worth trying to have the refund applied to a different credit card than the one used for the purchase. When I returned a couple of minor items to a Canadian Tire store, the CSR agreed do so.

9. Spread payments over several cards

To help meet minimum spends on more than one credit card, most retailers and service providers will allow you to split the payments over different cards. Keep in mind that if you’re relying on extended warranty insurance or certain types of travel insurance, this practice will render you ineligible if the terms and conditions state that you need to put the full costs on a particular card.

Conclusion

As with any strategy involving credit cards, never make frivolous purchases for stuff you don’t need. And ensure you’re able to pay your credit card balance in full every month. Going into debt isn’t worth it. Paying interest undermines the value you glean from credit card sign-up bonuses and defeats the purpose of using miles and points to save on travel costs.

Hopefully, these strategies will bring you closer to the next credit card with the next MSR and points bonus. With planning and organization, before you start working on one MSR, you’ll likely have the next one in your sights.

If you found this post helpful, please share it by selecting one or more social media buttons. Would you care to join the conversation? What other ways of meeting minimum spend requirements can you suggest? Please add your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- When a no-FOREX-fee credit card isn’t the best travel choice

- How to use Scene+ points to reduce travel costs

- How to use TD Rewards points to reduce travel costs

- How to use CIBC Aventura points to reduce travel costs

- Polaris review of United Airlines’ lounge and in-flight experience

Care to pin for later?

-

-

-

-

-

-

- Feature image: stevepb from Pixabay

- PIN image: Republica from Pixabay

-

-

-

-

-

Interesting idea – While on the subject of refunds, for in-store returns, it might be worth trying to have the refund applied to a different credit card than the one used for the purchase.

Thanks!

The article on “9 Effective Ways of Meeting Minimum Spend Requirements” offers practical tips that are super helpful! Whether for credit card bonuses or loyalty programs, these strategies make it easier to hit those spending thresholds without overspending. It’s a great resource for anyone looking to maximize rewards and get the most out of their spending. Well done!Thanks For Sharing.