Updated July 9, 2024

Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet? According to Credit Card Genius, it’s the best Air Miles credit card on the market. If most of the following features appeal to you, it certainly deserves some consideration.

Table of Contents

- 1. First year Free (FYF)

- 2. Sign-up bonus of 3,000 Air Miles

- 3. Air Miles are useful for travel

- 4. A decent MasterCard is handy to have

- 5. Limited 25% discount on flight redemptions

- 6. Earning rates between 1 and 3 mile(s) for each $12 spent

- 8. Airport lounge access

- 9. Insurance benefits

- 10. Access to Wi-Fi hotspots

- Conclusion

1. First year Free (FYF)

It’s usually offered with a first-year waiver of the annual fee ($120). The current ‘Offer Period’ from May 1, 2020 to November 30, 2024 includes such an offer. The fee appears as a charge on the first statement, accompanied by a credit for the same amount. A FYF promotion and an attractive sign-up bonus are key features of a tempting credit card offer.

2. Sign-up bonus of 3,000 Air Miles

The standard sign-up bonus is 2,000 miles on a $3,000 Minimum Spend Requirement (MSR) within the first three months. However, look for exclusive offers of 3,000 Air Miles at the BMO site, or at financial and miles-and-points blogs such a Credit Card Genius, Ratehub, Milesopedia, or Frugal Flyer.

If you like to have a healthy cushion of Air Miles in your portfolio, this offer allows you to rack up over 3,000 Air Miles within a short period. The average collector takes years to accumulate anywhere near this amount.

3. Air Miles are useful for travel

Air Miles will never lead to a suite or shower in the sky. Those luxuries are the stuff of frequent flyer programs offering redemptions in first or business class cabins. Air Miles is a poor cousin occupying a small, but useful corner of a diversified miles-and-points portfolio.

Air Miles can be redeemed for a variety of travel expenses including vacation packages, cruises, hotels, and car rentals.

For those of us who don’t live in or near busy airport hubs, Air Miles can be beneficial for short positioning flights to hubs served by airlines with other (and better) frequent flyer programs. This is my favourite use of Air Miles. For my trip from Halifax to Sydney, Australia next February, I’ve redeemed Avios points for a business-class QSuites redemption with Qatar Airways from Montreal. A flight from Halifax to Montreal costs 1,470 Air Miles and $99 in taxes and fees.

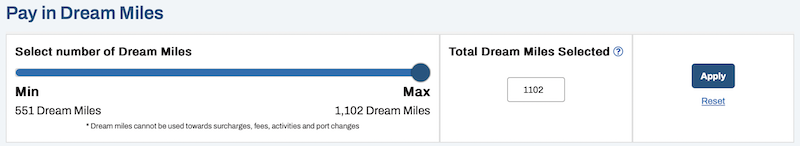

However, with the 25% discount for holding a BMO Air Miles World Elite MasterCard, the cost is reduced to 1,102 Air Miles.

For other travel, discounts of up to 20% are available on National Car Rentals and Alamo Rent A Car, and up to 5% on Enterprise Rent-A-Car at locations worldwide using the Car Rental Booking Tool.

Savings of up to 7% are available at Booking dot com properties with the MasterCard label.

4. A decent MasterCard is handy to have

I love American Express. But, let’s face it, there are places where AMEX cards aren’t accepted and it’s handy to have a decent Visa and MasterCard in your wallet.

And then there’s the in-store MasterCard-only policy of Costco.

Another dilemma concerns the MSR. It’s higher than that of many premium credit cards. For many people, it’s achievable by switching everyday spend to the card for the first three months. One disadvantage of doing so is that your other miles-and-points programs don’t benefit from a $3,000 spend. It’s a more difficult choice if it means missing out on one or two other attractive sign-up bonuses because you’re diverting such a significant spend to this one card.

The BMO Air Miles World Elite MasterCard is an easier choice when:

- There are expenses within the first three months with merchants that don’t accept American Express (but they do accept MasterCard).

- You regularly shop at Costco. If you come up short in meeting the minimum spend, consider investing in one or more Costco Shop Cards to use on future visits.

5. Limited 25% discount on flight redemptions

Back in 2017, BMO devalued the BMO Air Miles World Elite Mastercard flight benefit from a 25% discount to 15%.

Then in 2022, the flight redemption discount changed yet again. BMO Air Miles World Elite MasterCard cardholders now receive a 25% discount on one worldwide flight booking per calendar year, up to a maximum of 750 Reward Miles. This replaces the previous 15% discount flight benefit and can be spread across all tickets on the booking. To take full advantage of the discount, the combined cost of all flights on the booking would need to amount to 5,000 miles.

While the 15% discount was limited to North American destinations, the updated flight discount now provides cardholders with an additional 10% savings available on flights anywhere in the world. You don’t need to use your BMO Air Miles World Elite MasterCard to pay the taxes and fees to be eligible for the discount.

The option to use the flight discount benefit appears during the booking phase once flights have been chosen.

6. Earning rates between 1 and 3 mile(s) for each $12 spent

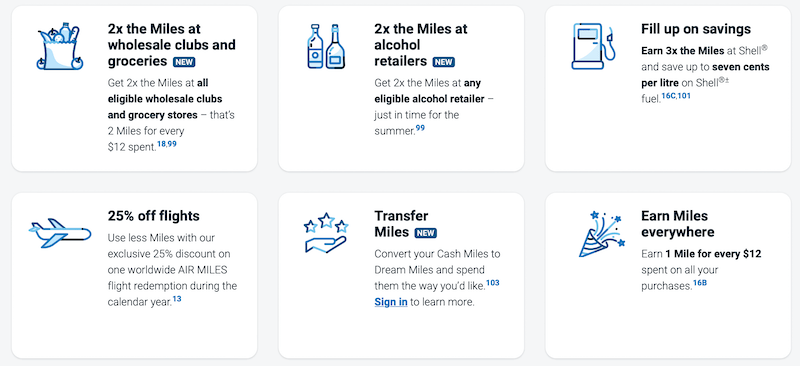

On each $12 spend, the base earning rate of 1 mile is now 2 miles at non-partner grocery stores and wholesale warehouses (such as Costco), and 3 miles at participating Air Miles partners.

Accumulating Air Miles based on organic spend can be a long and tedious journey. Credit card sign-up bonuses and points-boosting promotions are the best ways to accelerate earning rates. Newsletters from Air Miles will keep you abreast of points-boosting promotions.

Since BMO acquired Air Miles in June 2023, several new merchants and earning opportunities have boosted the desirability of the program. Hopefully, it is a sign of further improvements on the horizon.

7. Automatic Onyx status

Collectors who earn 5,000 or more Air Miles in a calendar year qualify for Onyx status.

A BMO Air Miles World Elite cardholder automatically qualifies for Onyx status.

Onyx members can enjoy bonus offers, up to 10% fewer miles when redeeming for merchandise, priority customer service, unlimited transfer of dream miles and cash miles, and select flight discounts. Beginning in 2025, a special travel discount of 40% or 500 miles off a flight will be offered for one month each year.

8. Airport lounge access

The card offers a Mastercard Travel Pass membership by DragonPass that includes access to over 1000 lounges globally, including Plaza Premium Lounges. At the time of this update, it remains to be seen if BMO Air Miles World Elite MasterCard cardholders will join BMO Ascend World Elite MasterCard cardholders with four annual complimentary passes. Otherwise, each visit costs USD 32.

Registration is required at MasterCard Travel Pass/Dragon Pass or use the MasterCard Travel Pass mobile app.

9. Insurance benefits

Despite the devaluation of the trip cancellation, trip interruption/trip delay and flight delay insurance for trips funded on points from different reward programs, the BMO Air Miles World Elite MasterCard offers a decent suite of insurance benefits:

-

Emergency medical insurance for the first 15 days on out-of-province/out-of-contry trips, up to $5 million in coverage (under age 65

-

Trip cancellation insurance for up to $1,500 per insured person and $5,000 per trip

- Trip interruption insurance for up to $2,000 per insured person and $10,000 per trip

-

Flight delay benefits of up to $500 per trip for reasonable expenses incurred on a flight delay of four hours or more

-

Car rental insurance and Collision Damage Waiver benefits, which allow you to save on the insurance fees that car rental companies usually charge

- Extended warranty and purchase protection where the manufacturer’s warranty is doubled, up to a maximum of one additional year and purchases are automatically insured against theft and damage for 90 days from the date of purchase

10. Access to Wi-Fi hotspots

Enjoy free access to over one million Wi-Fi hotspots around the world with Boingo Wi-Fi for Mastercard Cardholders. Register at wifi.mastercard.com and download Boingo’s Wi-Finder app for the easiest way to gain access.

Conclusion

Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet? It’s a worthy card to have if you

- don’t live in or near a major hub and use Air Miles for positioning flights

- use a variety of sources (e.g., miles, points, and cash) to fund travel

Might you be interested in my other miles-and-points posts?

- When a no-FOREX-fee credit isn’t the best travel choice

- Polaris review of United Airlines’ lounge and in-flight experience

- How to use TD Rewards points to reduce travel costs

- How to use Scene+ points to reduce travel costs

- How to use CIBC Aventura points to reduce travel costs

- 9 Effective ways of meeting Minimum Spend Requirements

If you found this post helpful, please share it by selecting one or more social media buttons. Is the BMO World Elite MasterCard in your wallet? Why? Why not? Please share your thoughts in the comments Thank you.

Pin it for later?

Great article. I didn’t clearly understand the idea of cancelling & reapplying esp this issue of doing it b4 the effective date of the new promotion. Does that mean if I have a bmo elite card now acquired in the last promotion (2017/18) I can’t cancel this card to apply under 2018/19 promotion becoz it began a few months a few months ago?

If the card you have is the BMO Air Miles World Elite MasterCard, you’re ineligible for this promotion if you cancel it and reapply during the period of the offer. The T & C are clear: “Existing BMO AIR MILES World Elite Mastercard customers who cancel their card during the “Offer Period” and existing BMO Mastercard customers who transfer into this Credit Card product during the “Offer Period” are not eligible for the Offers.”

Anne Betts recently posted…25 Tips on earning Aeroplan miles

I will be 70 in May. I am planning a 30 day European trip in September 2022. I have full medical coverage through my former employer, no age limit, no maximum in medical costs. I have a BMO World Elite Airmiles card that covers trip cancellation age 65 and under. My travel agent is trying to sell me more insurance for $690 for trip cancellation….does this make any sense? Thanks.

It’s not a blanket age restriction. The age restriction applies to pre-existing conditions. Take a look at the policy at 4.3.4 to see if it applies to you. $690? That’s steep!! That kind of premium would cover at least $7,000 of non-refundable travel bookings and I would presume that some of your bookings are refundable. Keep in mind that it’s only non-refundable bookings that are covered. I find that many travel providers are encouraging folks to travel, offering bookings that are completely refundable as incentives. Here’s a link to the BMO insurance booklet: https://www.bmo.com/pdf/AM_WE_Travel_Medical_Protection_Insurance_Certificate_En.pdf

What’s the minimum spend to get the 3,000 bonus airmiles on Creditcardgenius.ca? Also if I get this card as well as the American Express Airmiles Reserve, can I double dip on the benefit? BMO offers 25% off up to 750 airmiles, while the Amex offers annual companion voucher up to 1,700 airmiles back?

The Credit Card Genius MSR was the same as BMO’s public offer: $3,000.

I haven’t seen any restrictive language limiting access to both benefits. Unlike the buddy pass, they’re different benefits.