Updated October 30, 2024

What’s the best use of Scene+? Is Scene+ a useful program for travelling the world on miles and points? How does Scene+ work and what are the ways to use Scene+ points to reduce travel costs? How does it measure up against the former Scotia Rewards program? How does it compare to other fixed-point reward programs? These questions and more hopefully will be answered in this guide to Scene+.

Table of Contents

- Scene+ loyalty program

- How to earn Scene+ points

- Current Scene+ credit card offers

- Other Scene+ credit cards

- What’s the best use Scene+ points?

- How to use Scene+ points to reduce travel costs

- What qualifies as a travel purchase?

- Refundable bookings

- 11 Attractive features of the Scene+ program

- 1. Several ways to earn Scene+

- 2. Enhanced earning on travel purchases

- 3. Convenient system to cancel refundable bookings

- 4. Discounted annual fee

- 5. No FOREX fee

- 6. One-tier redemption value

- 7. Twelve months to redeem points

- 8. Excellent online redemption process

- 9. Access to rebates on credit card applications

- 10. User-friendly Scene+ app and online account

- 11. Access to AMEX offers

- Five shortcomings of the Scene+ program

- Final verdict

Scene+ loyalty program

Scene+ is the result of a merger between two former programs: Scotiabank’s Scotia Rewards and Cineplex’s SCENE with an effective date of December 13, 2021. In June 2022, grocery giant Empire joined as a third partner with a plan to replace Air Miles with Scene+ as its loyalty program.

Scene+ is a third-party program operated by Scene Limited Partnership (owned by Scotia Loyalty Ltd., a subsidiary of The Bank of Nova Scotia), Galaxy Entertainment Inc. (a subsidiary of Cineplex Entertainment LP), and Empire Company Ltd., the parent company of stores that include Sobeys, Safeway, Foodland, IGA, FreshCo, Needs,Thrifty, and Lawtons Drugs.

As such, Scotiabank no longer has an in-house loyalty program. This means that Scene+ points earned on Scotiabank credit cards reside in a third-party account. If the credit card that earned Scene+ points is cancelled, the points remain in the member’s Scene+ account, pooled with points earned on other Scotia banking products or a Scene+ Membership Card.

However, there are rules regarding activity. A Scene+ account may be closed, and points forfeited, without any earning or redeeming activity during any 24-consecutive-month period. But a member with a Scene+ Scotiabank product (a credit card or debit card in good standing) is exempt from account closure.

How to earn Scene+ points

The Scene+ program offers several earning opportunities. These include:

- sign-up bonuses associated with credit cards that earn Scene+ points

- everyday spending on a choice of seven credit cards earning Scene+ points

- purchases using a debit card associated with Scotiabank’s banking packages (Preferred Package, Ultimate Package, Private Banking, Student Banking Advanced Plan, Getting There Savings Program for Youth)

- purchases at partners such as *Empire stores (e.g., Sobeys and Safeway) and Home Hardware

- movie and entertainment purchases at Cineplex theatres or online at the Cineplex store

- cashback in points by shopping through the rebate portal, Rakuten

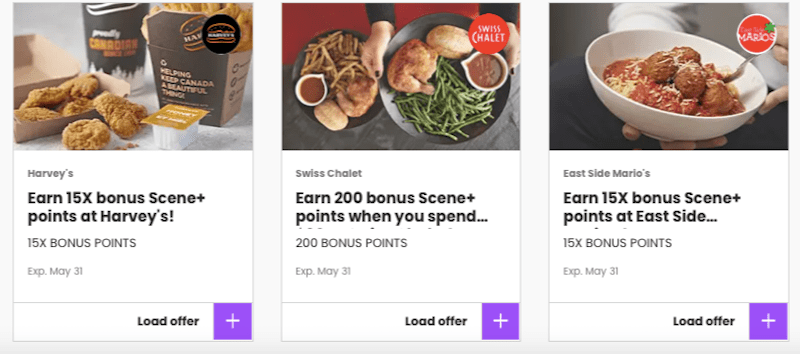

- dining at partners that include East Side Mario’s, Harvey’s, Kelsey’s, Montana’s, and Swiss Chalet

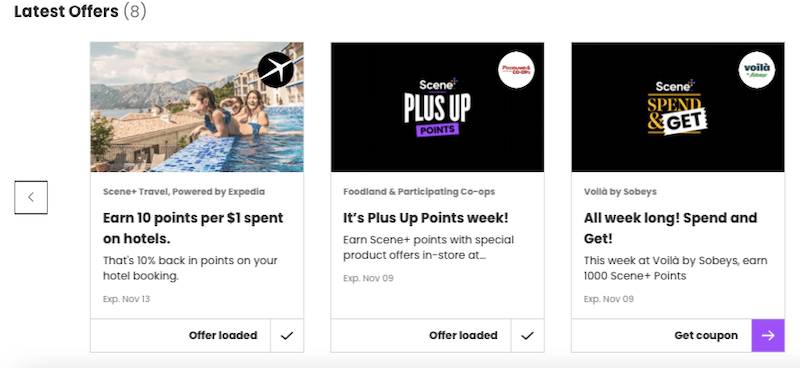

- booking hotel stays and car rentals through Scene+ Travel (powered by Expedia)

- purchases of games and eats at Playdium and The Rec Room

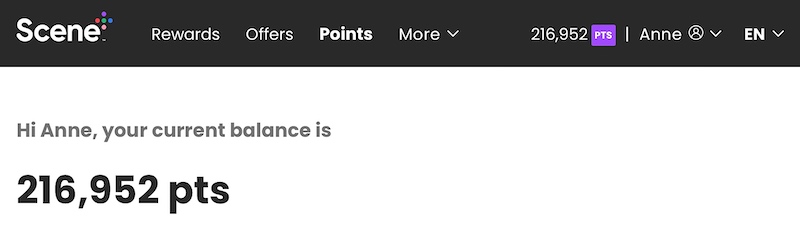

Another advantage of the merged program is that it’s possible to double-dip on earning at partner locations when using a Scene+ credit card and Scene+ Membership Card. Dining purchases at Swiss Chalet, for example, earn one point for every $3 spent and five points per dollar with the dining multiplier on the Scotiabank Gold American Express Card. Special offers increase the earning power.

It pays to check your Scene+ account on a regular basis for current offers from Scene+ partners.

*Empire stores include Sobeys, Sobeys Liquor, IGA, Safeway, Safeway Liquor, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Needs Convenience. In the Atlantic, Scene+ points can be earned at Lawtons Drugs that’s owned by Empire.

And of course, Scotiabank customers using select Scotiabank credit cards can ‘double dip’ by paying for purchases with a Scotiabank credit card that earns Scene+ points. At Empire grocery stores, the multipliers are higher.

- Scotiabank Gold American Express Card earns 6 points per dollar

- Scotiabank Passport Visa Infinite Card earns 3 points per dollar

- Scotiabank American Express Card earns 3 points per dollar

Current Scene+ credit card offers

Scotiabank usually has a first-year-free promotion on EITHER the Scotiabank Passport Visa Infinite Card or the Scotiabank Gold American Express Card.

The CURRENT promotion on the popular Scotiabank Gold American Express Card is in effect until January 2, 2025 with an annual fee waiver in the first year. The annual fee is $120, or $79 for seniors, that can be offset by applying through a rebate portal. The current rebate at Great Canadian Rebates is $125.

The Scotiabank Gold American Express Card earns:

- 25,000 Scene+ on a $1,000 spend in the first three months

- additional 20,000 Scene+ on a $7,500 spend in the first year

- 6 Scene+ per dollar spent at Empire grocery stores

- 5 Scene+ per dollar spent on groceries (at grocery stores other than Empire), dining, food delivery, and entertainment

- 3 Scene+ per dollar spent on gas, transit, and select streaming services

- 1 Scene+ per dollar spent on everything else

There’s no FOREX (foreign transaction) fee on purchases in a foreign currency.

The PREVIOUS promotion (ending July 1, 2024) on the Scotiabank Passport Visa Infinite Card saw an annual fee waiver in the first year (a saving of $150). The sign-up bonus was

- an attractive 30,000 Scene+ on spending $1,000 in the first three months

- an unattractive 10,000 Scene+ points on spending $40,000 each year

Besides having worldwide acceptance as a Visa card, attractive features of the Scotiabank Passport Visa Infinite include

- an accelerated earning rate of x3 at Empire stores

- accelerated earning rates of x2 on eligible grocery, transit, ride share, dining, and entertainment (applicable worldwide)

- no foreign transaction fees (2.5%)

- complimentary Visa Airport Companion membership and six lounge visits per year

Like most banks, Scotia offers a banking package where the annual fee on a credit card can be waived every year. For more information see the Ultimate Package bank account.

Other Scene+ credit cards

In addition to the Scotiabank Gold American Express Card, the other Scene+ credit cards are:

- Scotiabank Passport Visa Infinite Card

- Scotiabank Passport Visa Infinite Business Card

- Scotiabank Platinum American Express Card

- Scotiabank American Express Card

- ScotiaGold Passport Visa Card

- SCENE Visa Card

- SCENE Visa Card for Students

What’s the best use Scene+ points?

What’s the value of a Scene+ point?

Scene+ can be redeemed for Apple and Best Buy merchandise and gift cards, dining, movie tickets, and Scotiabank credit card account credits. Unless there are special offers, these types of redemptions are at a lesser value than when redeemed for travel.

The exception is at participating grocery stores where 1,000 points can be redeemed for $10 off grocery purchases. This is a value of one cent per point.

Travel redemptions are consistently valued at one cent per point (i.e., 10,000 points = $100). This applies to Scene+ Travel bookings, and those booked independently through other providers.

How to use Scene+ points to reduce travel costs

Much like the former Scotia Rewards Program, there are two ways to redeem points for travel. An advantage over the former program is that the minimum threshold of 5,000 points ($50) no longer exists.

1. Scene+ Travel

Scene+ Travel replaces the former in-house Scotia Rewards Travel Service. The service under the auspices of Expedia operates in much the same way as ExpediaForTD, the portal for members of the TD Rewards program (and CIBC by Expedia for members of the CIBC Rewards / Aventura program). Points can be redeemed against any travel booked via the portal.

Charge the full amount to your credit card, or against the points balance in your account. Or, use the part-points-part-charge option.

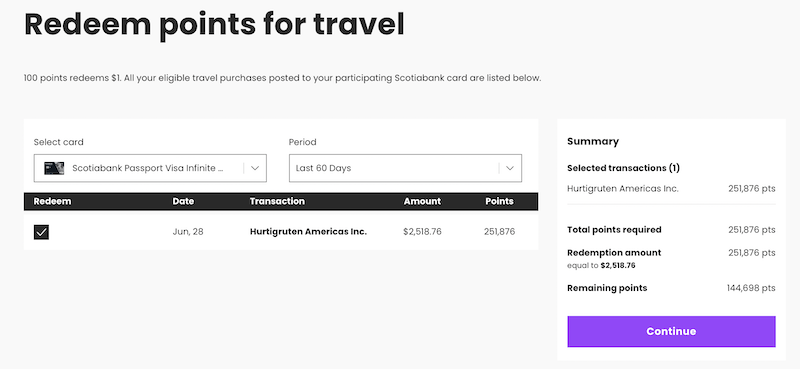

2. ‘Apply Points to Travel’

This operates in much the same way as it did under the former Scotia Rewards Program. It’s for bookings with travel providers other than Scene+ Travel.

Charge a purchase to your credit card and wait for it to post to your account. Points can then be redeemed against the purchase. This includes taxes, booking fees, airport fees, and travel insurance premiums.

A cardholder has 12 months from the posting date of the purchase to apply the points.

How to redeem using ‘Apply Points to Travel’

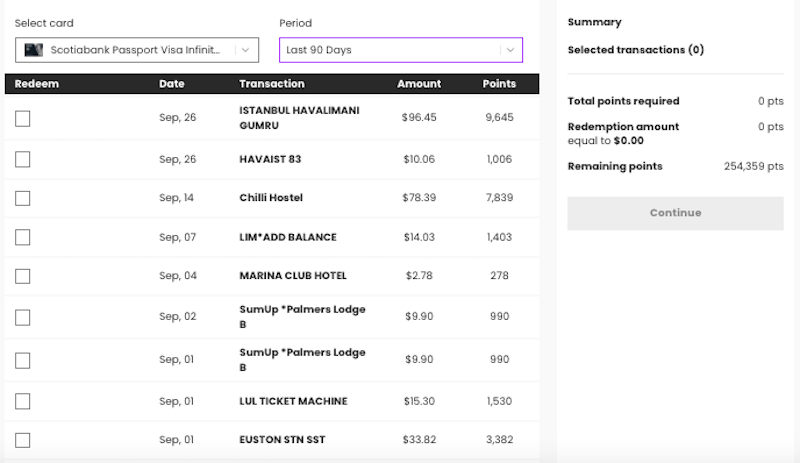

Log into your Scene+ account and navigate your way to > Rewards > Travel (under Spend your points) > Apply Points to Travel

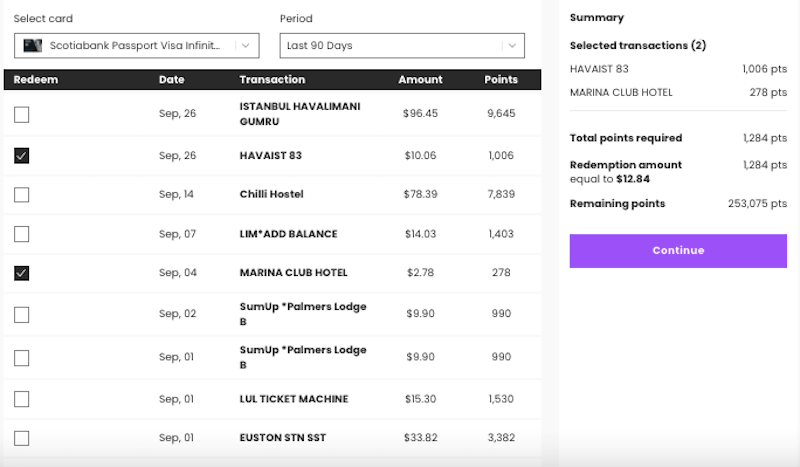

A drop-down menu will list the credit cards attached to your Scene+ account. Clicking on each credit card will reveal any purchases coded as travel in the period you select.

For example, in my case, all travel purchases charged to my Scotiabank Passport Visa Infinite Card in the last 90 days appear as a list. They include a visa for Türkiye, airport bus, hostel accommodation, transit card purchase and initial load, train ticket, scooter account top-up, and a drink at a hotel.

I can redeem Scene+ points for specific charges by selecting each one. The Summary box to the right shows me my selected charges, the total number of points I’ve chosen to redeem, the monetary value of those points, and the remaining points in my Scene+ account.

Clicking the ‘Continue’ button takes me to a confirmation page, and the information that the monetary value of my redemption will be credited to my credit card account in two to three days. A confirmation email with the same information is received within seconds.

What qualifies as a travel purchase?

To be eligible for redemption, the charge needs to be recognized as a travel purchase with merchant codes or identifiers set by the Visa network as:

- airlines and air carriers, airports, flying fields, and airport terminals

- lodgings, hotels, motels, resorts, trailer parks, and campgrounds

- travel agencies and tour operators

- automobile rental agencies, and motor home/recreational vehicle rentals

- passenger railways, bus lines, steamship, and cruise lines

Based on previous experience, I’ve found that charges for passenger railways, bus lines, and tour operators could be inconsistently included or excluded as candidates for redemption.

For example, Queensland Rail travel between Brisbane and Maryborough West in Australia was eligible as a travel redemption. A journey of a similar distance with Irish Rail between Dublin and Galway wasn’t.

Also, when a purchase is coded as entertainment, it’s excluded from the list of travel charges. This has an impact on tours. For example, tours of Dublin’s Kilmainham Gaol and Belfast Titanic were coded as entertainment. As a result, they didn’t appear on the list of eligible travel redemptions. Admission to Dublin’s Christ Church Cathedral for a self-guided tour wasn’t coded as entertainment, but it appeared on the list of possible travel redemptions.

Another observation concerned dining purchases if they were purchased at a hotel or while travelling by train. They appeared as travel purchases on my account and were therefore eligible as a travel redemption.

Refundable bookings

There are many reasons to make refundable bookings. One issue to consider is whether you prefer to be refunded in points or cash if you need to cancel.

If you book through Scene+ Travel and make a booking using points, your cancelled booking will be refunded in points rather than cash. If you prefer a cash refund, you should book through a platform other than Scene+ Travel (e.g., Expedia) using your Scotiabank credit card and prepay in full. Once the charge posts to your account as a travel purchase, use the ‘Apply Points to Travel’ feature and select the transaction for redemption. The points value of the charge will be deducted from your Scene+ points balance and the cash value of the charge will post to your account within a few business days.

Then, cancel the refundable booking. I find the online process at Expedia using the Virtual Assistant is user-friendly and efficient. The charge will be refunded to your credit card account within five business days.

11 Attractive features of the Scene+ program

When combined with Scotiabank’s best features, the Scene+ program offers several advantages.

1. Several ways to earn Scene+

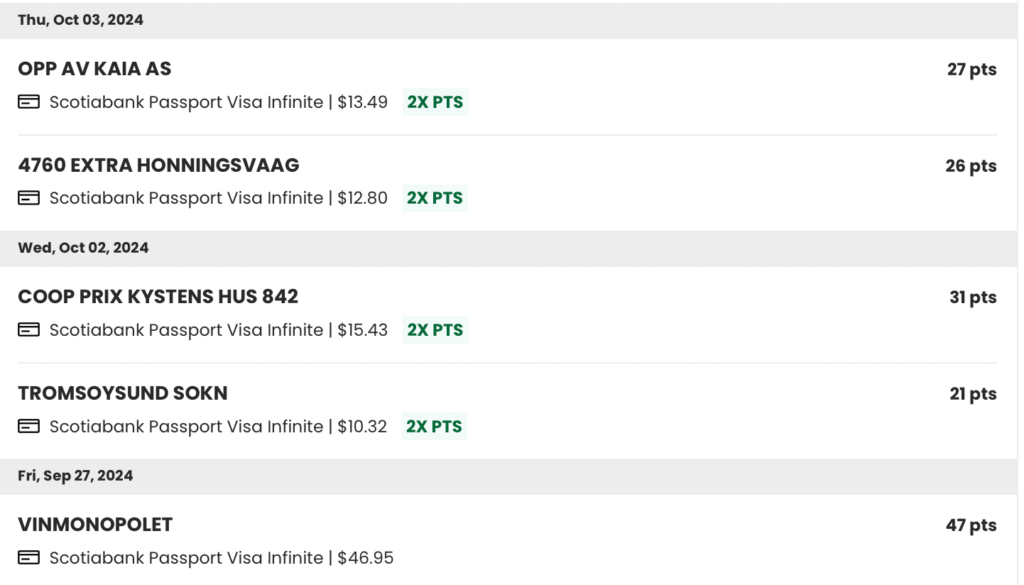

In addition to opportunities to earn points with Scene+ partners, Scotiabank has seven credit cards in the Scene+ family with several offering points multipliers for various types of category spending. If a charge falls into an accelerated-earning category, the respective icon is displayed beside the charge.

![]()

The best points multiplier is on spending using the popular Scotiabank Gold American Express Card. It earns 5 points per dollar on groceries, dining, and entertainment and 3 points on gas, daily transit, and select streaming services. (The multiplier increases to 6 points per dollar at Empire grocery stores.)

Only purchases in Canadian funds are eligible for the points multiplier (on the Scotiabank Gold American Express Card), but there have been reports of cases where the multiplier has been applied while travelling abroad. In my view, the best use of the Scotiabank Gold American Express Card is to use it exclusively for the x5 multiplier (x6 at Empire grocery stores).

The points multiplier on the Scotiabank Passport Visa Infinite Card applies to purchases in Canadian and foreign currencies.

For moviegoers, the Scene Visa Card (or the Scene Visa Card for Students) may be useful as a no-fee ‘forever card’ to build and anchor a person’s credit history. It earns x5 on purchases at Cineplex theatres or at cineplex.com, but its value to someone without a lengthy credit history is that it could help elevate a credit score and a person’s credit worthiness.

2. Enhanced earning on travel purchases

Scene+ credit cards earn 3 points per dollar (pre-taxes and fees) on hotel and car rental bookings at Scene+ Travel. The occasional offer (such as x10 points on hotel bookings in the fall of 2022) boost earning efforts. This is in addition to the points earned on the respective credit card.

3. Convenient system to cancel refundable bookings

The trip cancellation coverage benefit on most premium credit cards is limited to $1,500 with eligibility requiring that a significant portion of the trip expenses be charged to the respective credit card. Otherwise, purchasing trip cancellation insurance to cover non-refundable bookings is expensive. Having access to refundable bookings helps reduce travel costs.

Refundable bookings at Scene+ Travel are conveniently and efficiently processed by Expedia’s Virtual Agent. Clicking on the Customer Support link at the bottom of the confirmation email takes you to your Scene+ account login and then to the Virtual Agent where you’ll be prompted to enter your itinerary number or the last four digits of the credit card used for the booking. Once the Virtual Agent locates the booking, one click cancels it and an email arrives within seconds confirming the cancellation.

4. Discounted annual fee

Scotiabank offers discounted annual fees for seniors. The Scotiabank Gold American Express Card has a fee of $79 (as opposed to $120).

5. No FOREX fee

Scotiabank is to be applauded for being the first of the big-five banks to offer a no-FOREX-fee credit card to its Scotiabank Passport Visa Infinite Card. I suspect that dropping the 2.5% fee cuts into a lucrative profit margin but clearly it’s been worth it. Otherwise, Scotia wouldn’t have added this feature to the popular Scotiabank Gold American Express Card. Needless to say, it came with an annual fee increase from $99 to $120 and the downgrading of several benefits.

6. One-tier redemption value

Unlike other programs (e.g., TD Rewards), there’s no loss of value between using Scene+ Travel and other travel providers. The flexibility to book travel with any provider without any devaluation of points means cardholders can search for the best deal and use a vendor of their choice.

Dealing directly with a provider can be beneficial. In the case of flight delays and overbooked or cancelled flights, it’s my experience that service is better if the booking was made directly with the airline. For hotel bookings, it’s usually necessary to have booked directly with the hotel’s booking service to earn loyalty points and other loyalty program benefits.

(For AirBnB bookings, if you’re chasing Avios points, consider booking through the British Airways Executive Club portal to earn x2 Avios points on each pre-tax £1/€1/$1 spend on accommodation or experiences, plus what you earn on your credit card of choice.)

7. Twelve months to redeem points

Having 12 months to use the ‘Apply Points to Travel’ route means you don’t need to have the points when you book. You can accumulate the necessary points using the welcome bonus and points multipliers with your Scene+ credit card, and then redeem them when it’s to your advantage.

8. Excellent online redemption process

The online system for post-purchase redemptions is user-friendly and efficient.

9. Access to rebates on credit card applications

Scotiabank regularly uses affiliate partners that offer rebates on approved credit card applications. For example, the Great Canadian Rebates (GCR) current rebate of $125 on the popular Scotiabank Gold American Express Card is very appealing.

10. User-friendly Scene+ app and online account

Offers are loaded on the app and the Scene+ membership card is within easy reach to take advantage of earning opportunities. Tapping on an account holder’s points total reveals points-earning activity by date and credit card, with multipliers. A quick glance reveals if points and multipliers have been correctly applied.

The Scene+ app mirrors essential account information available at the Scene+ site.

11. Access to AMEX offers

While not a feature of the Scene+ program, the Scotiabank Gold American Express Card offers access to AMEX Offers which result in a statement credit by spending the required amount in single or cumulative transactions at certain vendors. Participating in AMEX Offers allows you to offset the cost of the credit card’s annual fee.

Five shortcomings of the Scene+ program

1. No way to extract greater value

Unlike CIBC Aventura, RBC Avion Rewards, and American Express Membership Rewards, at the present time, Scene+ doesn’t have a flight reward chart where it’s possible to extract a value greater than one cent per point.

For more information on the CIBC Rewards (Aventura) program, see How to use CIBC Aventura points to reduce travel costs

2. Limited number of travel expenses

The system of merchant codes and travel identifiers is mostly restricted to flights, accommodation, transit, car rentals, cruises, and travel packages. Attractions, tours, and sundry travel purchases are mostly excluded. In this respect, TD Rewards can be redeemed for a broader range of travel expenses.

For more information on the TD Rewards program, see: WHow to use TD Rewards points to reduce travel costs

3. Points can’t be transferred to airline or hotel loyalty programs

There are no conversion partners where it might be possible to extract a greater value than one cent per point on travel redemptions.

4. No option for 2FA by email

Scene+ is yet to expand its two-factor authentication to include email. Members with a physical SIM card and local number while travelling abroad cannot receive a text or call to a Canadian number that temporarily doesn’t exist or is not in service. For those with an eSIM card, it’s inconvenient to switch between the temporary and primary lines to receive a text. Unlike Aeroplan, I can receive an email to confirm my identity and log into my account to manage bookings. This isn’t possible with Scene+ and renders it less useful while travelling.

5. Cineplex booking fee

In June 2022, Cineplex undermined the convenience of online bookings by introducing a non-refundable booking fee $1.50 per movie ticket. The fee is discounted for Scene+ members (to $1.00 per ticket), and waived for CineClub members enrolled in Cineplex’s monthly subscription service. It doesn’t apply to movie tickets purchased at the theatre.

Final verdict

1. The x5 points multiplier on groceries, dining, and entertainment (x6 at Empire grocery stores) helps make the Scotiabank Gold American Express Card a useful keeper card for many cardholders, and a strong earner of Scene+ points.

2. The addition of Empire is exciting news for Scene+ members who find value in the Scene+ program and now earn points on grocery and drug store purchases at stores under the Empire umbrella. The points boost from x5 to x6 on purchases at Empire grocery stores on the Scotiabank Gold American Express Card is welcome news indeed.

3. The flexibility in redeeming Scene+ for purchases from any travel provider with no loss in value makes it a very attractive fixed value program. In this respect, it has the edge on the TD Rewards Program that has a two-tier redemption structure.

4. The ease of redeeming points online is a welcome user-friendly feature. Having 12 months to do so adds to the appeal.

5. Scene+ points are handy for a variety of travel expenses such as budget flights or those that aren’t part of a primary airline alliance/frequent flyer program. They’re useful for ground transportation, ferries, and miscellaneous accommodation that are outside existing airline and hotel loyalty programs. When used strategically, they can play a beneficial role in reducing out-of-pocket travel expenses.

6. The program has excellent potential as one of several secondary programs in a diversified miles-and-points portfolio. As such, it can be used to complement frequent flyer and hotel loyalty programs that are capable of generating a much greater value than one cent per point.

If you found this post helpful, please share it by selecting one or more social media buttons. Do you collect Scene+ points? If so, what’s your experience with the program? Please share your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- How to use CIBC Aventura points to reduce travel costs

- When a no-FOREX-fee credit card isn’t the best travel choice

- 9 Effective ways of meeting Minimum Spend Requirements

- Polaris review of United Airlines’ lounge and in-flight experience

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

- How to use TD Rewards points to reduce travel costs

Care to pin for later?

Hi Anne

Great article on a card I do not have yet.

One question. It says that the points credit may not show up for up to two statements. Does this mean interest is charged for those two months, then credited back or is the credit in the system but just not showing?

I would hate to leave any balance on a card even when a credit will eventually come.

Hi John. The credit appeared on my account much faster, and there’s no interest involved. Here’s an example using the Spirit of Queensland train fare. I charged it to my credit card in January and the $371.38 charge appeared on my next statement. Each monthly balance is paid in full so by the time I took the train in March, it had already been paid. When I returned from Australia in April, I redeemed 37,138 points and the credit voucher for $371.38 appeared in my account within a matter of days. That put my credit card account in the black at the end of April, and each subsequent charge on my credit card was deducted from that credit. Had I chosen to close the account with a credit, I could have asked for a cheque, or had it transferred to my no-fee Scotia credit card. Does this help answer your question?

Anne, hi. I have the same question on how many days are taken from the date of post-purchase redemption request to a date of showing up in a credit card account. The UP-TO 2 statement periods is really scaring me. You said that it took only several days in your example. Based on your experience , is a week realistic?

Hi Seong. Thanks for dropping by. My experience involved just a few days. It’s my sense banks are over cautious with their “up-to” advertised long periods for points, refunds, buddy passes and the like to be posted. I should think a week is a reasonable expectation despite the stated two statement periods.

Hi Anne, as March 8 2023, the Apply Points to travel Button seems to be gone as an option to redeem existing points. The only way left is to purchase a new trip through their portal powered by Expedia!

Hi Anne,

Although in theory the merger of ScenePlus and ScotiaRewards seems to be an excellent program, it is having some serious startup problems : missing points, missing multiplier points, as well as points double-posted including double-posted points for returns. Calculating an accurate points total is almost impossible. A month and a half after the merger the problems have not yet been resolved. Phoning in to rectify the points balance involves wait times of up to four hours plus. All of this for a points program that that involves annual fees. Disappointed? You bet.

Agreed, there have been lots of complaints, especially on multipliers. I’m fortunate in that my Scotia Rewards all converted to Scene+ but I’m taking a break from using Scene+ credit cards until there are reports that the glitches have been fixed. Some reports indicate a commitment to have it fixed sometime in February. Fingers crossed, as I quite like this as a secondary program.

Hello, Anne.

Although the merger of ScenePlus and ScotiaRewards appears to be a great programme in theory, it has a number of major initial issues, including missing points, missing multiplier points, and double-posted points, including double-posted points for returns. It’s nearly impossible to calculate an exact point total. The issues have not been resolved a month and a half after the merger. Calling in to correct the points balance can take up to four hours or more. All of this for the sake of a points programme with annual payments. Disappointed? Yes, absolutely.

Hello, Anne. I have the same issue about how long it takes from the time a post-purchase redemption request is submitted to the time the funds appear in a credit card account. I’m terrified of the UP-TO 2 statement periods. In your example, you mentioned it just took a few days. Is a week realistic based on your experience?

A week was realistic with the former Scotia Rewards program. I’m yet to make a redemption from the new Scene+ program.

Hi Anne, thanks for the review.

The lack of Forex fees is a big win for me and anybody who uses their VISA abroad.

However I noticed that booking travel although is ‘powered by’ Expedia, doesn’t offer the same benefits as using Expedia directly. i.e. must book flights and hotels separately, no packages or package discounts are available. I even did a head-to-head comparison for an upcoming trip to Miami and found the Expedia website price cheaper than via Scene+ Travel, which is very frustrating.

Thank you for this breakdown Anne. I have the Scotia Gold Amex and waiting for the Scotia passport in the mail. Im have no experience in this program and my question is, do my points combine from both cards or do I end up with 2 separate Scene+ accounts?

Marlene, your points combine in the same Scene+ account. You’ll see your total points and a breakdown of the points from your feeder cards. Many people have experienced problems with points being posted correctly, including multipliers, so it’s a good practice to check your points during these early months of the new program.

Greetings, I have a Scotiabank Passport Infinite card I’ve been using in the United States but I don’t seem to be accumulating scene rewards points. Are US dollar spends eligible for points? Tried to connect with Scenes.ca but don’t have time to wait for the estimated 1 hour and 45 minutes.

Yes, the Passport Visa Infinite earns Scene+ on foreign purchases, both base points and the multiplier. It sounds like you’re one of several people experiencing glitches during the transition from Scotia Rewards to Scene+.

This was really helpful – thank you so much! I was struggling to find information on the new program and you’ve summarized it in a very user-friendly way.

Hello. Do you know if AirBnB bookings can be redeemed as part of the Points for Travel program? Is it considered an Eligible Travel Expense?

Hi Cathy. AirBnB is a recognized accommodation provider by the Visa network so it should appear on your list of eligible travel redemptions on your Scotiabank credit card account that earns Scene+ points.Good luck.

Unlike with Scotia Rewards, booking airfare through the new Scene+ system is a complete horror show. People assisting with bookings are incompetent and most do not have adequate English language skills.

I have had exactly the same experience. Very disappointing after receiving consistently excellent service through the previous program.

Where can I find the redeem Scene+ points for travel purchases already made button.

I can see my points balance but can’t seem to find the button to redeem. Thanks

It should be in your Scotia account (not Scene+). Any purchases coded as travel should appear as eligible for redemption.

The apply points to travel is not operating at all like it used to with scotia rewards. I made several purchases in the last 6 months of airlines, hotels, taxis, etc. and none of them show up in the list for redemption. It’s really frustrating.

Also I used to get double points with my card on any travel bookings before and now it’s just regular points. And living overseas it used to also allow me to get bonus points on restaurants/ entertainment that wasn’t exclusively in Canada. Now not..

Says you need to phone if you want to apply “partial” redemption, as it isn’t yet available in the app. But when you live overseas calling doesn’t work. Overall just a huge disappointment since switching.

Thanks a lot for your summary – so useful. I’ve had a Scotiabank visa infinite since earlier this year. My question is, I have about 60000 scene + points. I’ve incurred hundreds of dollars of travel expenses within the last 6 months. Is there any downside to simply using the “apply points to travel” option and cashing everything out? Am I missing out on any potential better use of the points? Doesn’t seem like it to me, but I’m new to this program, so just wanted to ask an expert.

Thanks!

Hi Jonathan. Unless there are special offers, I’m assuming travel redemptions at a penny a point offer the best return. The only downside I can think of to NOT using the points now against recent travel expenses is the possibility of a devaluation. I like to think that’s not likely in the near future given the need to attract members and build confidence in the Scene+ program.

My mother just got her visa infinite scene card in the mail and she is ready to collect points.

After reading this I’m a little concerned. We planned on paying our travel agency with the card to earn points, but I’m starting to see that won’t work. Will we earn points for booking tours and whatnot when not using the travel portal? Do you earn points with every purchase?

Thanks for the help

Yes, you earn points with every purchase. So is it the Scotiabank Passport Visa Infinite Card? If so, the earning rate is 1 point for every $ spent, except it increases to 2 points per $ on groceries, dining, entertainment, and daily transit. So if you pay your travel agent $500, 500 points will be earned on the purchase. Does this help?

I just got a new Scene+ card from my local Foodland store. When I went to register it I was not happy that I was expected to enter a credit card number as well to complete the process. I found that very suspicious and unless I can be convinced that it is necessary I won’t bother with the card.

Scene is terrible to deal with, please if you are reading this DO NOT GET ANY SCENE CARD! I ordered a 100 dollar gift card that never came. I have called and emailed for months and they will not return my points, so I’m out 100 dollars. All banks have points now, go to one that works, scene is garbage.

It is March 2023 and Scene+ still is in a mess. It is unclear whether they give 3x points for flights and hotels (as they advertise) or 1 point for every dollar spent. Just got back from Europe where all travel and hotels were paid for using Scotiabank Infinite Passport card and only 1 point/$spent appears on statement. The call centre staff are, for the most part, absolutely useless. Why is it called Powered by Expedia? Do you have to book through Expedia?

Thanks for this information. I’ve been trying to confirm with Scotia Passport Visa Infinite Card that even foreign purchases earn points (1 point per dollar). Is that your understanding? Purchases made around the world still earn points?

Thank you!

Yes, the Scotia Passport Visa Infinite earns points on all foreign transactions. It also earns points on the multiplier categories. So if you use the card in any country on dining or groceries, it earns x2 points. If you link it to your Uber account, you’ll earn x2 on the ride-share category. All the best.

Hi, thank you so much for the article!! Very useful. Wondering if I already have the Passport VISA and wanna apply the Gold AE (first time). Can I still get the first time bouns points?

Scotia doesn’t enforce their terms and conditions. If you’re approved for the Gold and meet the Minimum Spend Requirements within the prescribed time, you’ll receive the bonus. In fact, you could hold more than one Passport Visa Infinite and more than one AMEX Gold (at the same time) and receive the sign-up bonus each time. Good luck.

This article is a fantastic deep dive into the Scene+ program and its potential for reducing travel costs! The detailed breakdown of earning opportunities, redemption options, and credit card features is incredibly useful for anyone considering Scene+ as part of their travel hacking strategy. I particularly appreciate the clear explanation of the ‘Apply Points to Travel’ feature and the flexibility it offers for bookings outside Scene+ Travel. The comparison with other programs and honest assessment of its shortcomings provide a balanced perspective, making it easier to decide how Scene+ fits into a points portfolio. Thank you for such a thorough and insightful guide—it’s a valuable resource for travelers looking to maximize their rewards!