Credit card insurance takes the bite out of costly insurance premiums. But, what is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points?

Table of Contents

It depends

All credit card insurance policies have restrictive conditions. When it comes to travelling on points, coverage for trip cancellation, trip interruption and flight delays is governed by two key factors:

- Most policies stipulate that the full cost of the trip, or a significant percentage of the costs of the trip, be charged to the credit card in question.

- When travelling on points, coverage usually applies only if the points come from the loyalty program associated with the respective credit card.

Why is this an issue?

Firstly, trip cancellation insurance is expensive. It costs in the range of $100 for each $1,000 of coverage of non-refundable expenses. The last quote I received was $517.50 for $5,000 of coverage. When I enquired about increasing the $1,500 of coverage on one of my credit cards to $2,500, it would have cost $100.

Secondly, it’s an issue for folks who redeem miles and points for travel. It might not be for those with only one or two credit cards, and points in only one travel reward program. Take the person with an Aeroplan account whose credit card of choice is a TD Aeroplan Visa Infinite Card. S/he would have $1500 of trip cancellation coverage on a trip partially funded on Aeroplan points. But, s/he needs to charge the full cost of the entire trip to the TD Aeroplan Visa Infinite Card.

It’s a different story for miles-and-points enthusiasts. These travellers tend to manage diversified miles-and-points portfolios consisting of several reward programs. Points used to fund a trip usually come from more than one program.

These travellers have several credit cards. They use each card as strategically as possible to maximize their earning and redeeming potential. One way is by applying for cards offering handsome sign-up bonuses. Many cards have a Minimum Spend Requirement (MSR) that unlocks the bonus. In addition, they’ll use cards that offer points’ multipliers on travel expenses.

Travel costs are one way to meet an MSR and/or earn double or triple points. For these people, placing trip expenses on just one credit card is unrealistic because it undermines their points-earning efforts.

There’s a solution

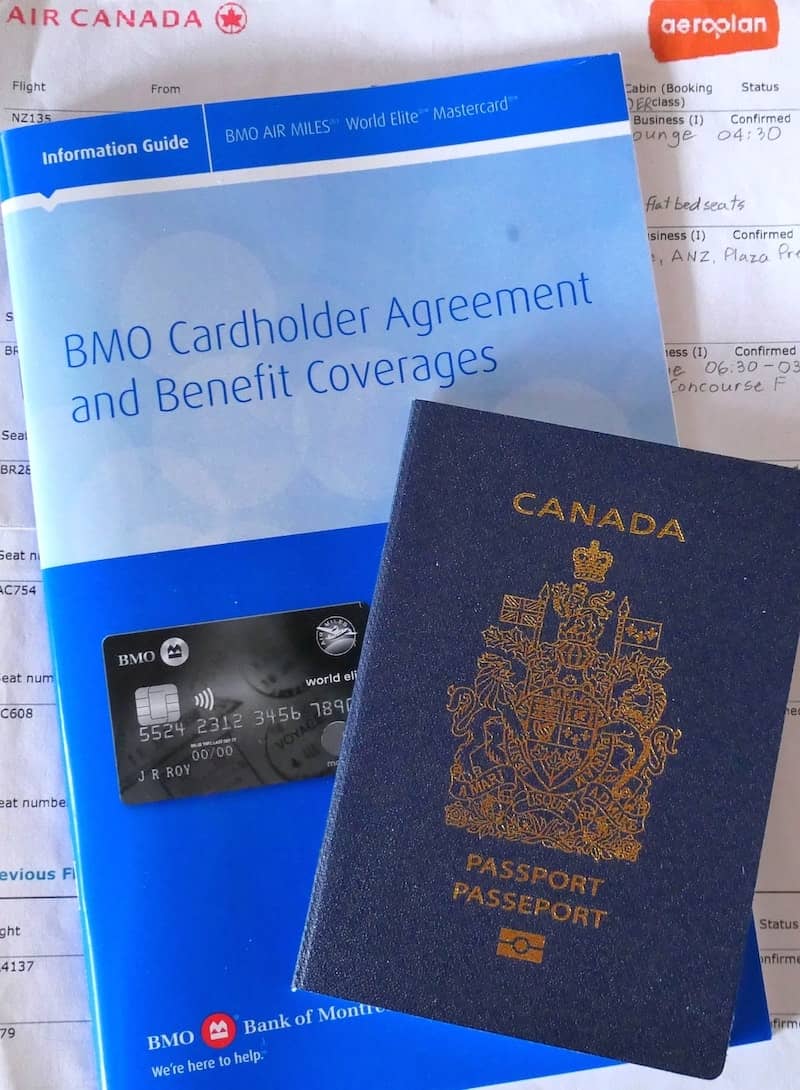

Bank of Montreal (BMO) offers two “World Elite” MasterCards – the BMO Air Miles World Elite MasterCard and the BMO Rewards World Elite MasterCard.

Both are unique. They offer trip cancellation, trip interruption/trip delay and flight delay benefits for trips funded on points from different reward programs.

Policy references

For simplicity, I’ll reference one card only – the BMO Air Miles World Elite MasterCard (BMO AM WE MC).

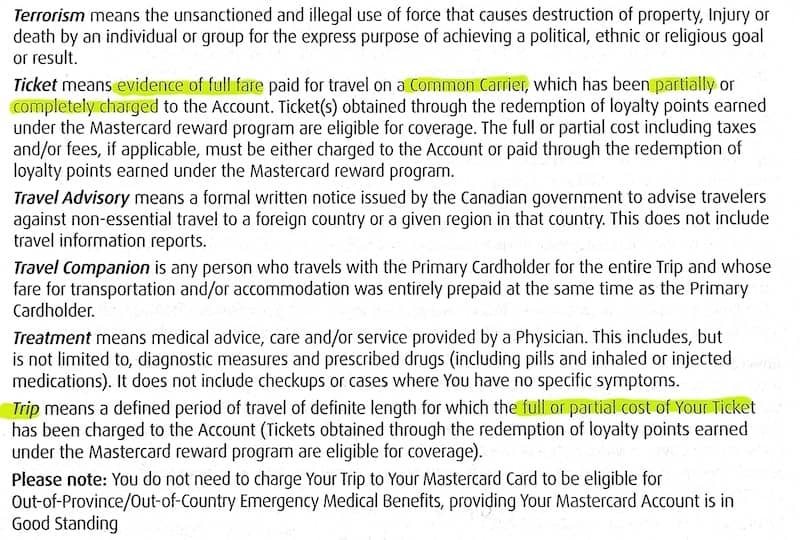

There are four significant references in the policy to four key terms: “partial,” “trip,” “ticket” and “Common Carrier.”

- “Coverage applies only when You charge the full or partial cost of Your Trip…” (Reference: 4.3.1 but it’s similar in other sections)

- “Trip means a defined period of travel of definite length for which the full or partial cost of Your Ticket has been charged to the Account (Tickets obtained through the redemption of loyalty points earned under the Mastercard reward program are eligible for coverage).” (Reference: 1. Definitions)

- “Ticket means evidence of full fare paid for travel on a Common Carrier, which has been partially or completely charged to the Account. Ticket(s) obtained through the redemption of loyalty points earned under the Mastercard reward program are eligible for coverage. The full or partial cost including taxes and/or fees, if applicable, must be either charged to the Account or paid through the redemption of loyalty points earned under the Mastercard reward program.” (Reference: 1. Definitions)

- “Common Carrier means any land, air or water conveyance for regular passenger service, which is fully licensed to carry passengers for compensation or hire and which undertakes to carry all persons indifferently as to who may apply for passage, so long as there is room and there is no legal excuse for refusal.” (Reference: 1. Definitions)

Policy interpretation

Any “ticket” (that’s part of a “trip”) on a “Common Carrier” that is fully or “partially” paid with the BMO AM WE MC triggers eligibility for coverage of the entire “trip.”

Before leaving your home province, use your BMO AM WE MC to purchase a common carrier ticket that’s part of the trip. It can be a ticket on a flight, train, bus, or ferry. It could be the taxes and fees on the award flight from home to your destination. Or, it could be another award flight from a stopover or destination where the taxes and fees are charged to the BMO AM WE MC.

There’s some confusion regarding two key points. In miles-and-points circles. I’ve encountered these two assumptions:

- For award travel, coverage is limited to trips booked on points earned under the MasterCard reward program; and

- If Aeroplan points (or points from some other reward program) are redeemed for the flights to and from your destination, there’s a requirement to pay the taxes and fees of that particular booking using the BMO AM WE MC.

In each case, these assumptions are incorrect. In the second case, using the BMO AM WE MC will trigger eligibility for coverage, but it’s not a requirement.

Seek confirmation of your interpretation

Before each trip, call Allianz at 1-877-704-0341. Describe your circumstances and share your interpretation. Ask if your interpretation is correct and if you’re eligible for coverage.

Here’s an example. You redeem Aeroplan miles to book a return trip to Australia. You pay the taxes and fees with a credit card that’s not the BMO Air Miles World Elite MasterCard because it’s not yet part of your credit card portfolio. As the trip draws nearer, you book a few domestic flights on Qantas using British Airways Executive Club’s Avios points. You now have the BMO AM WE MC so you pay the taxes and fees with it. Doing so triggers eligibility for coverage. You’ve paid the partial cost of a ticket with a Common Carrier that’s part of your trip.

When the agent agrees that coverage is triggered, ask for a confirmation number of the conversation. Record the agent’s name, date, and confirmation number and add it to your travel file.

Coverage limits

- The $2500 trip cancellation coverage that comes with the BMO AM WE MC is an attractive feature. Many credit cards limit this benefit to $1500 or $1000.

- Trip interruption coverage is capped at $2,000 per insured person.

- Flight delay benefits (a delay of more than six hours) are limited to $500 per account.

- The Baggage and Personal Effects insurance covers up to $750 per insured person up to a maximum of $2,000 per account per trip.

These features make the BMO Air Miles World Elite MasterCard one of the most coveted credit cards in my portfolio.

What to pack

1. A copy of the policy

Who can commit to memory the intricacies of the policy?

For example, You must cancel Your Trip with the travel agent and notify the Operations Centre within forty-eight hours of the event, which caused You to cancel Your Trip.

Or, Flight Delay Benefits are payable in the event of a delay of more than six hours in the arrival or departure of Your regularly scheduled airline flight. You will be reimbursed up to a maximum of $500 per Account per Trip, for reasonable, additional accommodation and travelling expenses. Expenses must be incurred by You as a result of the delay. You will be required to submit original, itemized receipts for any expense that You incur in this regard. Prepaid expenses are not covered.

Pack a copy of your policy. A booklet is sent with your credit card, and the latest version is available online. Dropbox, or some other file storage platform, is a perfect place to store a digital copy.

2. The telephone number of the administrator

In the event you need to seek clarification of policy requirements as they relate to your circumstances, have the telephone number of the administrator close at hand. Add it to your list of contacts in your Smartphone, or include it on your Emergency Contact Card. For more information, see How to make a traveller’s emergency contact card.

Set up a means to call a landline from your Smartphone. Voice over Internet Protocol (VoIP) apps such as Skype and Viber are low-cost options.

3. Storage system for receipts

I like to carry a zippered see-through pouch for storing printed materials such as bookings, instructions, and ‘stuff’ collected along the way. It’s not large because most things can be stored digitally, or scanned with an app like Scanner Pro. Pop a couple of internal organizers such as paper envelopes to separate receipts where originals are required.

Conclusion

Conditions and exclusions are features of every insurance policy. This post focuses on a narrow element: credit cards that offer trip cancellation, trip interruption and flight delay insurance for trips on points. In this regard, the BMO World Elite MasterCards stand head and shoulders above their competitors. It’s a compelling reason to keep one of these cards in your travel wallet.

What do you use for trip cancellation, trip interruption and flight delay insurance for trips on points?

Might you be interested in my other miles-and-points posts?

- Is a no-FOREX-fee credit card always the best choice for international travel?

- Finding Aeroplan flights: a step-by-step guide

- Is the TD Rewards program worth it when travelling the world on miles and points?

- What’s the best use of Scene+ (formerly Scotia Rewards) for travelling the world on miles and points?

- Is the BMO Air Miles World Elite MasterCard a good deal?

- Why the Best Western loyalty program is good for travellers

- Lounge and flight review of United Airlines’ Polaris experience

Pin for later?

Trackbacks/Pingbacks