Updated July 4, 2021

Finding the cheapest way to send money abroad is easier when hidden fees and markups on exchange rates can be uncovered. Here’s a step-by-step approach to identify your options.

An example

Like many travellers, I encounter the occasional need to transfer money abroad. The latest involves sending 100 AUD to Australia to help secure a group booking of shared accommodation. The individual receiving the 100 AUD deposit from several people identified a bank account for this purpose.

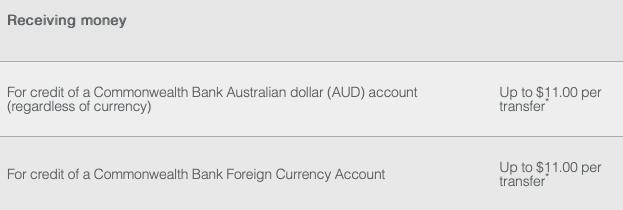

Another factor to consider is what charges will be imposed on the receiving party. My friend was advised by his bank that a fee of up to 11 AUD would be imposed on each overseas deposit.

I knew from previous experience that bank and Western-Union transfers were costly. However, these were a few years ago so it was clear I needed to get up to speed on the latest options within the expanding FinTech sector.

What’s the cheapest way to send money abroad?

Here’s the four-step approach I used to select a service and execute a transfer.

Step 1: Identify your needs

Circumstances vary from person to person, country to country, and transfer to transfer. The following questions might help narrow your search for an appropriate service.

- How much do you need to send? Or, asked another way, how much does the person need to receive in the destination currency?

- Are both countries served by the companies being considered?

- Is there a fee? If so, is it a flat fee? Or, is it based on a percentage of the transfer? Is the fee the same for all countries, and both directions of a country-to-country transfer? Is it the same for cash pickup, and bank and mobile wallet transfers?

- Is the exchange rate at *mid-market value or is there a markup? If there’s a markup, does it fluctuate with the amount of money being sent?

- How long will it take for the money to be received?

- What do the sender and receiver need in order to send and receive the funds? Do both need a bank account? Is there a brick-and-mortar location where the money can be picked up in cash? Can the receiver obtain the funds through a mobile wallet? Can the sender use a credit or debit card? Do both need a PayPal account, or accounts with the money transfer company?

- What information (about the receiver and the sender) does the transfer service need?

- Can the transfer be executed online or through a mobile app?

- How are the sender and receiver kept up to date on the status of the transfer?

- Is customer service available 24/7? Can the company be contacted by email, chat, or telephone?

- How secure is the process?

* The mid-market rate is the actual value of one currency on the world market when compared to another currency. It’s the midpoint between the ‘buy’ and ‘sell’ prices of the two currencies. It’s also known as the ‘interbank rate,’ the rate banks and transfer services use to trade currency among themselves.

Step 2: Ask Monito

The award-winning Swiss company Monito helps users navigate the maze of money transfer fees and exchange rates. Their easy-to-use online tool allows people to quickly find, compare, and evaluate several money transfer services.

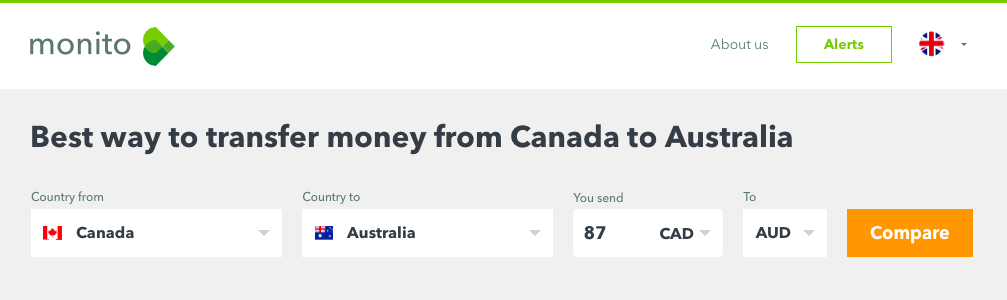

Insert the amount you need to send, and the currencies involved. Or, play with the online tool until it reveals the amount needed in the receiving currency. In my case, I kept adjusting the amount in CAD ($87) until it equated to 100 AUD on the online calculator.

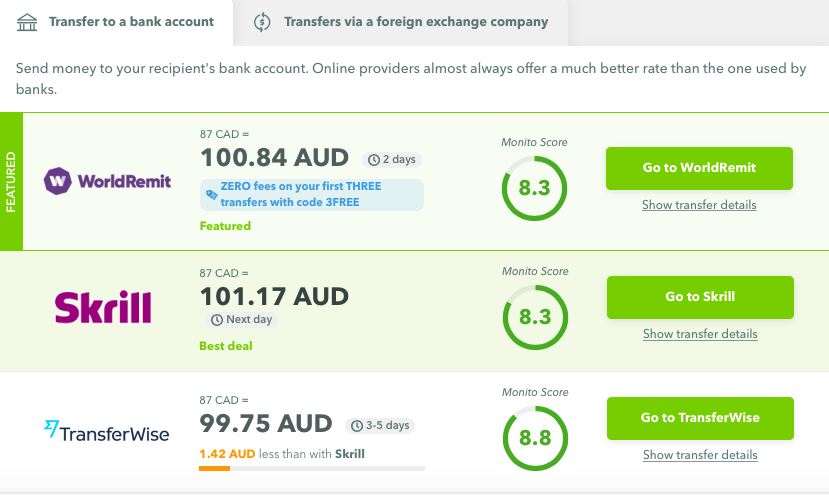

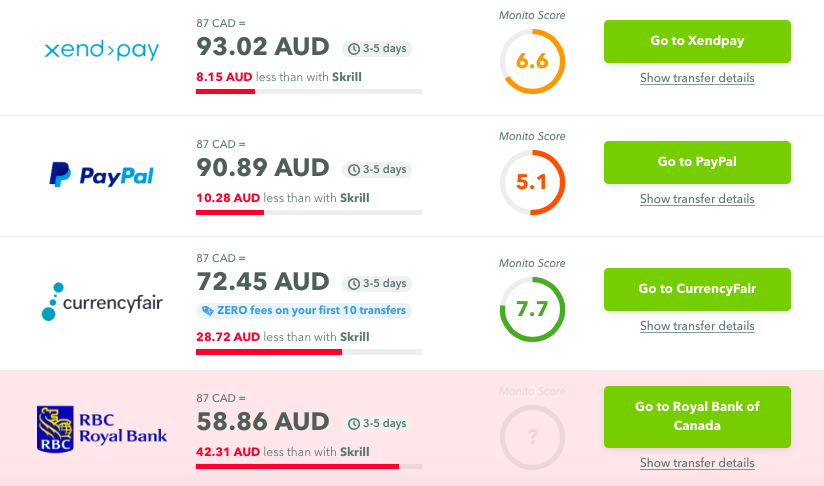

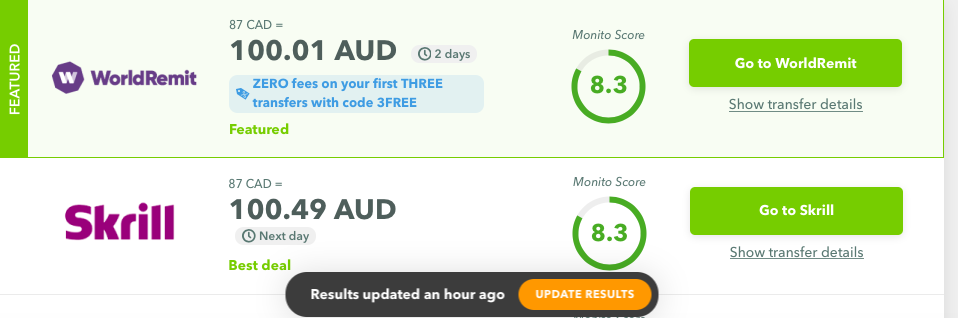

Monito’s live comparison tool incorporates fees and exchange rates in the cost of the transfer. Several options are presented, from the cheapest to the most expensive.

Calculations are updated regularly, with information on when the last update took place. An option to update the results is one click away.

Monito displays the amounts to be sent and received, and the maximum time for the transfer to reach the recipient. Also displayed is Monito’s rating, and links to further information.

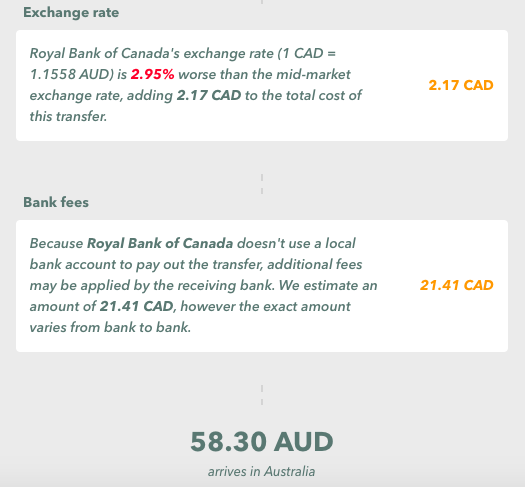

For example, the “Show transfer details” link takes the user to information on fees and exchange rate markups.

Step 3: Compare your top choices

If you need more information, Google will help you drill down further on what looks like your best options. A simple search of, for example, “TransferWise vs. WorldRemit” should offer a deeper analysis with relevant links.

Otherwise, skip this step and use the links within Monito to choose your transfer service provider.

Step 4: Initiate a transfer with your chosen provider

For this transfer, I chose WorldRemit. The service had several appealing features:

- fast delivery

- no fee on the first three transfers (normally $3.99 from Canada to Australia)

- small margin on the mid-market rate (1.09%): palatable for small transfers

- ability to use a credit card (Visa, MasterCard, or Maestro)

- easy-to-use online interface, and mobile apps for Android and iOS

- ability to track the progress of the transfer through the app

- cash pickup in some countries

- perfect 10/10 score from Monito on credibility and security

- overall, excellent reviews from customers

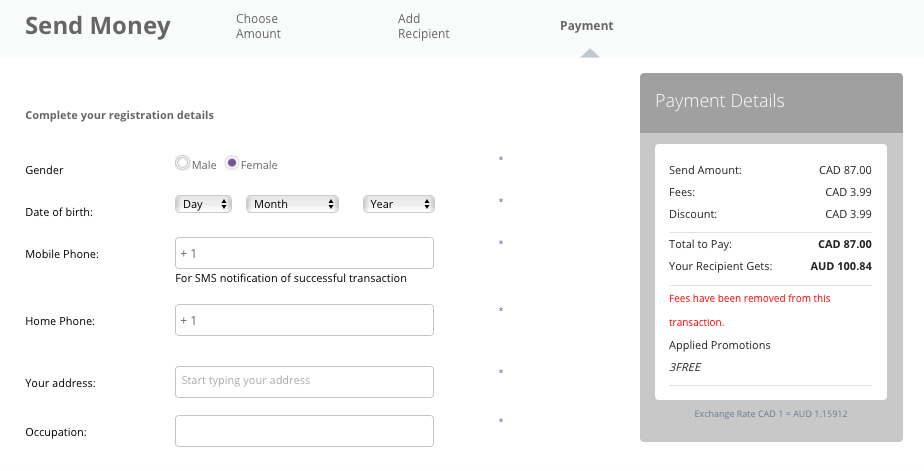

The interface for setting up an account and initiating a transfer displays easy-to-follow steps.

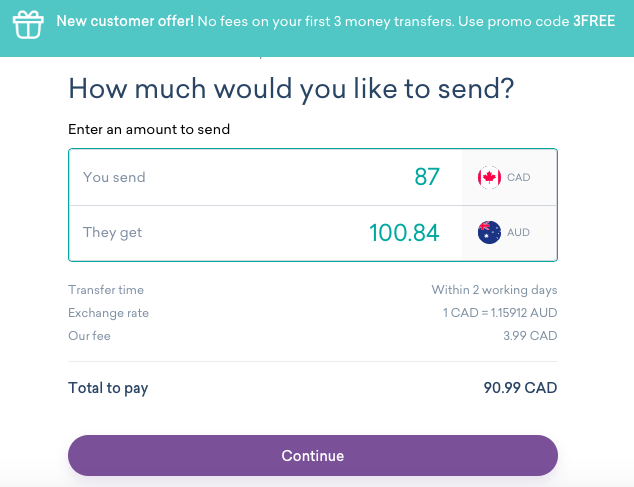

Before setting up an account, the amount to be sent and the amount to be received were clearly displayed. The fee, that I presumed would be removed at the payment stage, was also shown.

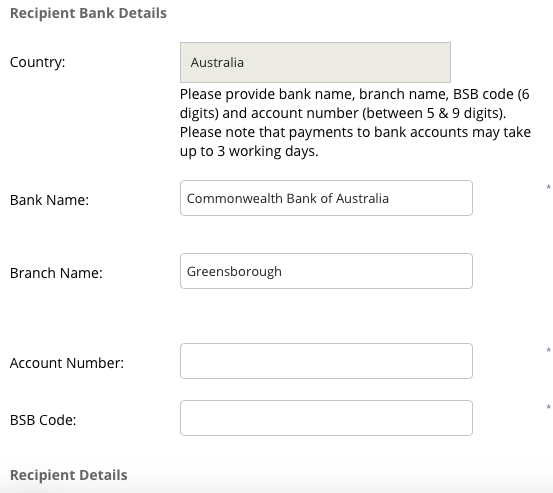

It helps to have recipient details on hand. The following were required for deposits to a bank account:

- bank name

- branch name

- account number

- bank’s BSB code

- recipient’s name, address, mobile phone number and email

Account set up required my name, gender, date of birth, mobile telephone number, email address, password, and occupation.

I didn’t need to upload any identity documentation or address verification. However, I was asked to choose one of four reasons for the transfer:

- family or friend support

- purchase of services

- property payment

- sending funds to self

The thought crossed my mind that ‘sending funds to self’ may attract a cash advance fee when using a credit card. Despite choosing ‘property payment,’ a cash advance fee of $3.50 appeared on my credit card account a couple of days later. With a cash advance, interest starts accruing from the date it’s posted; there’s no interest-free grace period. Immediately paying off the balance limits the amount of interest that’ll be charged. In addition, cash advances don’t normally qualify as points-earning opportunities on credit-card spend.

The verdict

For this particular transfer of 100 AUD from Canada to Australia, WorldRemit was the cheapest way to send money abroad. It cost 95 cents (the actual cost of the 1.09% margin on the mid-market markup). Applying the coupon code “3FREE” at the payment stage resulted in the deduction of the $3.99 fee.

It won’t necessarily be the cheapest option for sending larger amounts, or when transferring funds to other countries.

I received confirmation texts and emails within seconds of initiating the transfer. One hour and 26 minutes later, WorldRemit advised that the transfer was complete. The recipient received a similar message confirming the transfer amount and reference number. The deposit was listed as a 100.84 AUD direct credit via the payment gateway service Citibank Europe WorldPay Ltd.

Overall, I was impressed with the service. For my next international transfer, I’ll use Monito to explore the options. Payout methods, currencies, countries, and amounts have an impact on costs. One thing is certain — using a licensed money transfer company is much cheaper than using a bank’s transfer services.

A few days after sending the transfer, I logged into my WorldRemit account and noticed a referral code for the company’s new referral program. This feature didn’t surface in my research so it wasn’t a factor in my choice of a service. It’s certainly an added benefit of WorldRemit.

If you found this post helpful, please share it be selecting one or more social media buttons. What money transfer service do you use to send money abroad? Please add your thoughts in the comments. Thank you.

Pin it for later?

Feature image by Klimkin from Pixabay

Very helpful, thanks for doing the research for the rest of us