Updated November 25, 2023

Stuff happens. These 10 essentials of packing for a travel medical emergency will prepare you for when it does.

Table of Contents

Stuff happens

Here’s a summary of my last ‘stuff-happens’ story.

It had drizzled on and off during the four hours spent exploring the Port Arthur Historic Site in Tasmania, Australia.

The on-and-off donning of my rain jacket kept me dry. I can only assume an insect became trapped and bit my arm in a valiant effort to escape. I felt nothing at the time, but by nightfall, the three bites were visible and a little itchy. No worries, I put it down to one more example of countless past encounters with insects.

By morning, I was dealing with a severe reaction. The bites oozed something unpleasant and the surrounding area had developed an oval-shaped mass of redness.

I reached into my first-aid kit for antihistamine pills and a blister pack of hydrocortisone cream. While out and about, I visited a pharmacy and picked up an ointment containing a mixture of lidocaine hydrochloride (to quell the itch) and cetrimide (an antiseptic). This eased the itch but after four or five days, the redness had spread and swelling had developed. It was clear I was dealing with an infection and needed medical attention.

When ‘stuff happens’ becomes a medical emergency

I read up on cellulitis and figured I’d better get my arm to a doctor who could prescribe an antibiotic.

On a Sunday of a long weekend, my options for finding a doctor were limited to the emergency department of a hospital.

Thank goodness for emergency medical insurance.

This was in 2019. The medical consultation in Hobart cost AUD 549. Pathology services were AUD 134.50. The cost of filling the prescription for antibiotics was AUD 5.50.

Initially, the emergency room doctor wanted to administer antibiotics intravenously. This would have involved several hours at the hospital. After hearing of my imminent flight to Sydney, she consulted her supervisor. They decided to prescribe the oral antibiotic Cephalexin, and send a tissue sample to the pathology department for analysis.

Had in-hospital treatment continued, would it have involved a bed? If so, the listed hospital rates showed a day-only bed rate of AUD 1993 and an overnight bed rate of AUD 2349. And I presume that intravenous antibiotics would have come with a hefty price tag.

All this to say is that when ‘stuff happens,’ it can be expensive. Who would have thought three tiny insect bites could result in an expense of AUD 689 (CAD 660 or USD 494)? Or, presumably much more had the intravenous treatment proceeded.

10 Essentials of packing for a travel medical emergency

It doesn’t hurt to be prepared for something we hope to never use or encounter. Here are ten suggestions on things to pack in your emergency preparedness kit in case you’re faced with a medical emergency on your travels.

1. Emergency medical insurance

Believe it or not, some travellers embark on a trip without emergency medical insurance.

Some don’t know what to look for in a policy, or where to purchase it. I see the questions repeatedly asked in travel forums, in one form or another.

So, I’ve never in my life purchased travel insurance, partly because I didn’t know it was a thing and partly because I go through life (for better or worse) thinking nothing is ever going to go wrong. Watching what people are dealing with… Wow! Bankruptcy — makes me think I should start considering it. So — where do I start? How does it work? What does it cost? Explain like I’m 5. Thanks!

Some travellers figure the expense isn’t worth it when there’s little chance of an injury or illness.

My mom was 78, living alone, very active, and well traveled. Several times during the trip she stated, “I always buy trip insurance, but we’re just sitting by the pool at the resort…what could happen?” Well, on the last day, she slipped on the deck by the pool at the resort and shattered her hip. Because she didn’t have travel insurance, she was unable to be evacuated home to the US for treatment. She had surgery at a nice hospital in Cancun. However, Medicare doesn’t pay anything outside of the US. Blue Cross (her supplemental) reimbursed at 80% months later, after we sent in all the paperwork. We (myself, my mom, my brother, and my uncle) had to put $65,000 on credit cards to get her released after the surgery. Add the interest we accrued until Blue Cross paid us back. It was a very costly decision not to take the insurance, which is cheap! She came home and then developed a staph infection in her hip that she got during the surgery. She ended up very, very sick and was in the hospital and rehab for 8 months. She required 24/7 care for the rest of her life, never again drove, traveled, bathed herself, or walked without a walker.

Or, a short cross-border shopping trip ‘goes south:’

A day trip for shopping turned into a disaster about 45 days ago in Bellingham. I had to spend 2 nights in intensive care after surgery. Total bill: USD 115,000.

I stupidly didn’t purchase supplemental insurance since it was only for a few hours. Will *MSP help at all outside of the CAD 75/day? I’m about to file for the paperwork and just wondering how much I should be preparing for out of pocket. I don’t have enough savings to cover that so not sure what next steps are. Thanks for any tips.

*MSP: Medical Services Plan, Province of British Columbia, Canada

Or, another describes the hoops involved in getting treatment:

My travel partner had a seizure getting on the plane in Cancun, Mexico. He ended up staying 3 days in the hospital. They wanted a credit card for $10,000 before they would treat him! It cost $800 for the ambulance from the plane to the hospital. They walked me to the bank machine to get paid! He had insurance but we had to contact the company directly before the doctors would even look at him!

My heart goes out to these authors and their families for the stress and financial hardship they faced. These situations, and so many others like them, beg several questions, including “Why travel with emergency medical insurance?”

These are my thoughts.

- If you know your insurance policy has you covered, you’re more likely to seek medical attention when it’s most needed.

- Chances are greater you’ll receive treatment without unnecessary delays. If you don’t have adequate coverage, you could be bounced to another facility, or denied treatment altogether.

- Your insurance administrator will advocate on your behalf. It could direct you to an accredited health care facility in their network. It can set up direct billing arrangements between the insurer and the facility.

- Your insurer’s medical staff will consult with medical personnel providing care. They can also liaise with your doctor or family members back home.

- Presumably, your insurance administrator has an understanding of what costs are appropriate under the circumstances. Without an insurance provider negotiating on your behalf, you’re at the mercy of unscrupulous providers.

- If medical evacuation is needed, your insurer will make the arrangements. For example, as soon as my cousin was stable following an accident in Florida, a Learjet was dispatched to return him to Nova Scotia for continued (and cheaper) treatment. His insurance covered all costs on a direct-billing basis.

- Medical expenses can be very expensive. It can result in a severe financial burden (or ruin) for the traveller, or for family members who come to your rescue. As such, travelling without emergency medical insurance is both negligent and selfish. The risks aren’t worth it for you, or others who help out in your time of need.

2. Health Card

This is a Canadian example, but it likely applies elsewhere. In Canada, an eligible resident of each province or territory has access to publicly funded health care services. To obtain medical attention, a person needs to produce her/his health card. Within Canada, reciprocal agreements exist between most provincial/territorial jurisdictions.

My friend from Ontario sought medical attention at a clinic in Nova Scotia. She had her OHIP card (Ontario Health Insurance Program) and her out-of-province/out-of-country insurance policy card. All that was needed was her OHIP card.

The clinic resembled a ‘mini-hospital.’ It performed several diagnostic tests and kept her overnight. In the morning she was transported by ambulance to the regional hospital, two hours away.

All medical costs, and the facility-to-facility ambulance service were covered by the reciprocal inter-provincial agreement concerning Ontario and Nova Scotia.

However, this is not always the case when travelling within Canada (or between different medical jurisdictions in your home country). For example, in Canada, not all costs are covered when travelling outside the home province. These include accidental dental care, prescription drugs, ambulance (including air ambulance), and transportation back home. In addition, Quebec isn’t part of the Interprovincial Reciprocal Billing Agreement for physician services so travellers to and from Quebec may have to pay some medical costs up-front and seek reimbursement from their provincial plan. Also, each province or territory has different fee structures and travellers may be liable for the difference. Prior to travel, contact your provincial plan for accurate information.

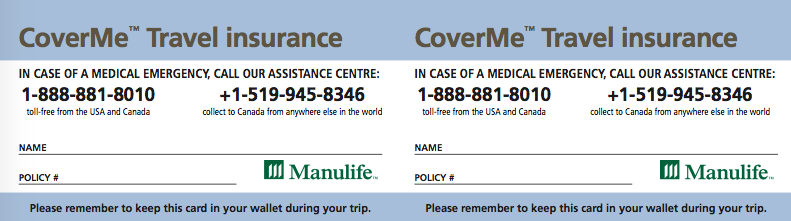

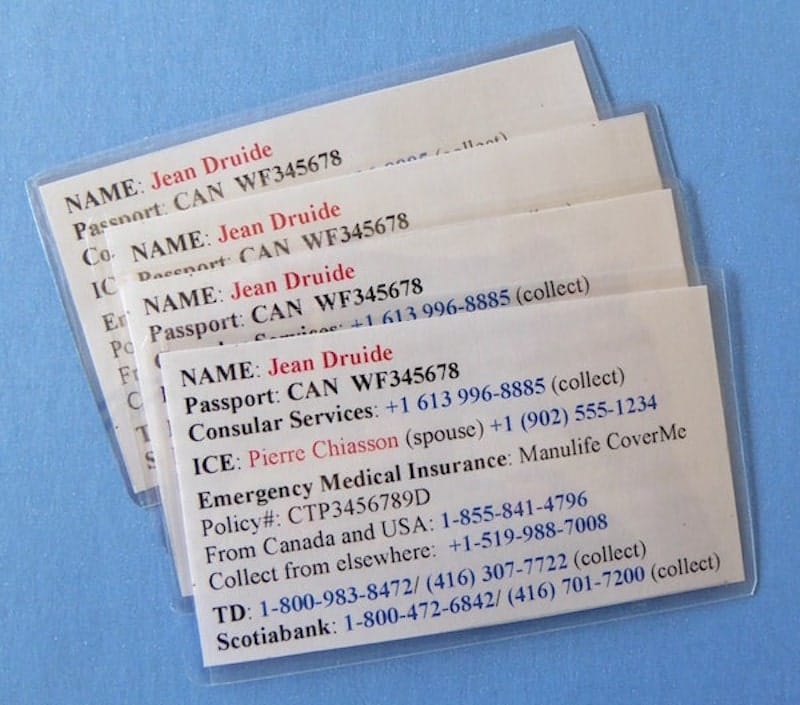

3. Emergency contact card

Most insurance policies require contact with the insurer’s administrator before medical consultation or hospitalization (or as soon as possible following an accident or the onset of a sudden illness). If your insurer provides a card for your wallet, pack it. It will undoubtedly include telephone numbers, and perhaps your policy number. If not, add them.

I make my own. It’s an opportunity to carry several emergency numbers in one place. I’m talking ICE (In Case of Emergency) contact person, Consular Services, financial institutions, and so on. I carry laminated copies: one in my wallet, another in my passport sleeve, one in a pocket of my phone case, and one in each bag. In Tasmania, I showed the card at the registration desk for recording the name of my insurer, policy number, and contact information.

There may be times when you’re not in a position to speak for yourself. An emergency contact card that can be easily found by travelling companions, first responders, or medical personnel can be invaluable. Someone can call the insurer’s administrator on your behalf and set the wheels in motion for treatment and payment. If your emergency contact card contains an ICE contact, someone can contact that person on a timely basis.

See How to make a traveller’s emergency contact card in five easy steps for more information.

4. Copy of insurance policy

Download a copy of your insurance policy. Email a copy to yourself or store it in Dropbox. It may come in handy.

From my initial contact with the insurance administrator, my understanding was that direct billing would be established. When I received a bill from the hospital, my first inclination was to pay it. But, it was reassuring to be able to consult my policy for guidance. On my second call to the insurance administrator, I learned that direct billing hadn’t been set up, and I received authorization to pay the account in full. It was an opportunity to confirm that initial work had been started on my claim and confirm the deadline date for submitting it.

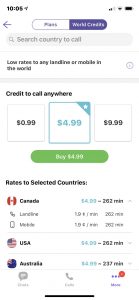

5. The ability to call a landline in your home country

It’s useful to have the ability to call consular services, financial institutions, or insurance providers in an emergency. It removes some of the angst from what can be stressful situations.

In Tasmania, I called the insurance administrator before seeking treatment. My local SIM card and plan came with a handsome number of minutes for international calls. I just needed to have the exit code from Australia, and the country code for Canada. For some reason, I wasn’t able to make a collect call from my phone (or figure out how to do so).

On another occasion I needed medical assistance abroad, I contacted the insurer as soon as I returned to the hotel. It was following a tumble at Petra in Jordan, when I was transported to the hospital by ambulance. I described my injuries, treatment, and costs, and the need to have stitches removed several days later when I’d be in Istanbul. It was reassuring to have it confirmed that I’d called on a timely basis, and receive authorization for subsequent treatment.

In Jordan, I didn’t have a local SIM card and prepaid plan. For those occasions, I use a VoIP (Voice over Internet Protocol) app to make calls over Wi-Fi. My go-to app is Skype with Viber Out as a backup option. Loading credit prior to travel translates into cheap VoIP calls. If one service has a poor connection, it’s reassuring to have a backup.

6. Passport, or a copy of the information page

On occasions I’ve sought medical attention abroad, I was asked to present my passport. Some travellers advocate carrying their passport at all times; others prefer to leave it in a secure place at their accommodation. Whatever your preference, I suggest carrying a laminated copy of the information page in a readily accessible location. Your passport might be in a difficult-to-reach spot whereas your copy should be easily accessible and available at all times, to both you and first responders.

For more information, see 9 Simple reasons to carry laminated copies of your passport.

In Tasmania, my laminated copy gave the hospital administration staff the information they needed.

A copy of my passport, and the emergency contact card, expedited the process at the hospital’s registration desk. I was thankful to have both at my fingertips. Without them, I doubt the process would have proceeded as smoothly.

In fact, in other scenarios, I might have been denied treatment or asked to pay for the treatment in advance.

7. The ability to pay for treatment

In Jordan I was fortunate. The hospital didn’t have the means to accept payments by credit or debit card. Thank goodness it cost only 88 Jordanian Dinars (CAD 138) and I had enough cash on hand.

In Australia, I was billed, and received it via email.

When my cousin was involved in an accident in the USA, the insurance administrator directed him to a hospital in their network. A direct billing arrangement was established at the outset. In my case, in Australia, I suspect that it wasn’t possible to set up direct billing as it was a Sunday of a long weekend and the appropriate staff weren’t on duty.

8. Decent credit/charge card limit

If you need to pay for services, it’s useful to have a decent credit or charge card limit, and know what it is.

Does your debit card have a daily limit on withdrawals at an ATM? Do you know how to remove or raise the limit? Do you have the necessary information to access your account or confirm your identity when you call? By way of example, my daily withdrawal limit is CAD 500. The daily limit and system of email alerts help me protect and monitor my travel account. I can temporarily raise the limit with a telephone call to my financial institution. Having voice recognition set up expedites the process.

Do you have a password manager? It’s invaluable for recording passwords, security answers, credit limits, and other critical account details. I use DataVault.

9. Google Maps

It’s a cluttered space in the app world, but Google Maps is up there with the best. Where’s the nearest medical centre or hospital? Ask Google Maps. How do I get there? Google Maps will show the way.

On a Sunday of a long weekend in a foreign city, what’s the closest open pharmacy to get a prescription filled? Google Maps to the rescue. Within a matter of minutes, my prescription was filled and I was on my way to the airport for the flight to Sydney.

10. First-aid kit

You can still pack light with a first-aid kit assembled with your predicted needs in mind. New Zealand’s legendary sand flies taught me to pack enough antihistamine to deal with the inevitable reaction to foreign insect bites. The ‘Tasmanian Devils’ of Port Arthur have prompted me to ask my family doctor for a prescription for Cephalexin prior to each trip. I’ll gladly spend the CAD 6 to have it filled as a precautionary measure against a similar reaction in future.

Some additional tips

Annual vs single trip insurance coverage

When researching emergency medical insurance, compare the cost of an annual multi-trip plan with that of a single-trip plan. You may find very little difference in cost. For example, in August 2023, I renewed my annual plan with Blue Cross. As most of my trips last several weeks, I have insurance for an unlimited number of trips up to 31 days each time, $0 deductible, $5 million in coverage. If a trip is for more than 31 days, I purchase an extension. The cost to renew my plan was $422. My first trip is for 46 days so with the 15-day extension, I paid $466. Had I purchased a single-trip plan for 46 days, it would have cost $455. In effect, emergency medical insurance for future trips up to 31 days within the next 12 months is costing $11!

Investigate MedJet Assist

MedJet Assist’s tag line is

“Insurance gets you to the ‘nearest acceptable facility.’ MedJet membership can get you home.”

For MedJet members who become hospitalized 150 miles / 241 kilometres from home, either domestically or internationally, MedJet arranges medical transportation to a home-country hospital of the member’s choice for inpatient care. Access to medical transportation is regardless of medical necessity and there are no adventure travel or pre-existing condition exclusions. The only cost to the member is the membership fee.

Speak to a pharmacist

Depending on the jurisdiction, pharmacists can assess and recommend suitable treatment options, including a prescription if necessary. It may save you the time and expense of visiting a doctor.

Conclusion

These ten simple packing strategies can help make the process of obtaining emergency medical assistance as seamless as possible. No one hopes or expects to use emergency medical insurance coverage, but when stuff happens, a little preparation and organization can make a huge difference.

Might you be interested in these related posts?

- How to make a traveller’s emergency contact card in five easy steps

- 9 Simple reasons to carry laminated copies of your passport

- How to assemble a perfect travel first-aid kit

- 25 Ideas on how to assemble an emergency preparedness toolkit for travellers

- Emergency ID bracelet for travellers

If you found this post useful, please share it by selecting one or more social media buttons. Also, would you care to join the conversation in the comments? Do you have any other tips or comments on what to pack in case of a travel medical emergency?

Pin for later?

Image by Alexas_Fotos from Pixabay

In addition to medical coverage, it is critical that your travel insurance policy covers Medical Evacuation and Repatriation, whose costs can be staggering. This is especially critical in more remote and less developed places, but is applicable everywhere.

Make sure the insurance policy covers pre-existing conditions, which can be an issue with American policies.

If you travel often, consider an annual policy, which will be much cheaper than insurance for each trip.

Medical insurance coverage in America is extremely complicated – you can go to an in-network ER – and be treated by out of network doctors who will send enormous bills. Some states have laws dealing with “surprise bills” – but others don’t. Also, ambulances may not be covered – and they charge a fortune.

Thanks for the info.

But I hope that wasn’t your REAL personal info that is showing on the Emergency Card for all to see.

This article is one of the m@ost informative pieces of information I have read about traveling. I will be sure to follow-up on the many suggestions. Thank you Anne!

I travel a lot for work and in my younger days I didn’t put much thought into preparing for medical emergencies while traveling. That all changed when I broke my foot overseas, that was an expensive lesson to learn! Excellent advice and some points I hadn’t thought of, thank you Anne!

Fred recently posted…Ham Radio Terms A to Z

Oh my! Not the way you you’d want to spend your holidays but definitely great tips for being prepared just in case!

Wonderful list I absolutely will use it the next time I’m packing to go abroad!

This is such an important post. I have anaphylaxis to several foods and so when I travel anywhere I have to consider the chance that I may end up in the hospital. In Australia, I spent 48 hours in the emergency after accidentally eating a trace of peanut. Because of my medical condition, I’ve always been on top of packing medications and paperwork whenever I travel. It’s very important!

I’m convinced the US has the worst medical / insurance system on the planet lol It is horrible for residents and can be extremely expensive for visitors without proper coverage – the medical card is a great idea. My friend was bitten by a stray dog in Thailand – she left the clinic with a styrofoam cooler full of rabies shots.. that she was allowed to carry on a domestic flight. Insane. Unheard of here.

I am so shock everytime I hear (or read) that people are traveling without travel insurance. They are so important and cheap compared to the amount you may have to pay in case of an accident. I am Canadian too (from Quebec) and we took extra insurance to travel across the country, as rates are different in each province. Great article and tips.

The part where you mentioned that you had to deal with a severe reaction got me worried about myself. Although I have my antihistamine supply, I can never tell when would I need emergency medical treatment. It would’ve been better if I were to find an urgent care clinic that could attend to my needs just in case we can’t find nearby hospitals.

Thanks for writing this post! I used to get so excited while planning my trips that I completely neglected being prepared for any medical emergency while travelling. We feel this won’t happen to us but this is something which should be on top of our list, especially when you’re travelling abroad.